EPFO account holders were expected to get the interest money (PF Interest Rate) on the amount deposited in PF by December-2022. The major reason for this was that in the last financial year also the interest rates were revised in the month of March and the money was transferred in December 2021, but this could not happen.

Interest transfer expected before Holi

After the announcement of changes in the rules regarding PF during the budget, the expectation of the account holders has increased again that soon the interest money received on the amount deposited in PF for the financial year 2022-23 can come in their account.

If media reports are to be believed, a similar possibility is being expressed in them that before Holi, the government can give a big gift to the members of the Employees’ Provident Fund Organization (EPFO). No official announcement has been made by the government regarding the interest of PF.

Know the new rules for PF withdrawal

Talking about the change in PF rules, on February 1, 2023, while presenting the general budget of the country, the government had announced relief regarding the withdrawal of EPF money. Under the new rule, now TDS deduction on withdrawal of money deposited in PF has been reduced from 30% to 20%. This decision of the government will benefit such PF account holders whose PAN card is not updated in their PF account.

EPF e-nomination

Important news for all salaried classes. Employees’ Provident Fund Organization (EPFO) has made e-nomination mandatory for its subscribers. If you do not do this then you will not be able to check your PF balance. With this, the family of the account holder gets social security. EPFO is continuously tweeting about this, in which it has been told how subscribers can file e-nomination for EPF / EPS.

EPF e-nomination is mandatory

EPFO is also providing the facility of e-nomination to give the information of the nominee. Those who are not enrolled in this, they are being given a chance. After this, information like name of the nominee, date of birth will be updated online. EPFO has told its subscribers that EPF account holder should do e-nomination (EPF / EPS nomination). By doing this, it helps the nominee / family members to withdraw money related to PF, Pension (EPS) and Insurance (EDLI) in case of death of the account holder. With this, the nominee can also claim online.

7 lakhs facility is available

EPFO members also get the facility of insurance cover under the Employee Deposit Linked Insurance Scheme (EDLI Insurance cover). In the scheme, a maximum insurance cover of Rs 7 lakh is paid to the nominee. If the member dies without any nomination, then there are difficulties in processing the claim. So let’s know how to fill nomination online.

This is how you can do e-nomination in EPF / EPS

- EPF / EPS First EPFO’s official website Nomination Https://wwwkepfindiakgovkin/ visit

- Now click here FOR EMPLOYEES in the Services section and Member UAN / Online Service (OCS / OTCP Click on )

- Now a new page will open on that login with UAN and Password

- Select E-Nomination under Manage Tab. By doing this, the Provide Details tab will appear on the screen, then click on Save.

- Now click on Yes for family declaration, then click on Add family details (Here you can add more than one nominee.

- Here for total amount share click on Nomination Details, then on Save EPF Nomination Click.

- Now click on E-sign to generate OTP here, now enter OTP on registered mobile number linked in Aadhaar.

- By doing this, your e-nomination gets registered with EPFO. After this you do not need to send any hard copy document.

How to check after money transfer

Via SMS

To check balance through SMS, send the message ‘EPFOHO UAN ENG (if you want information in Hindi, write HIN instead of ENG)’ to 7738299899. You will get the balance information in the reply.

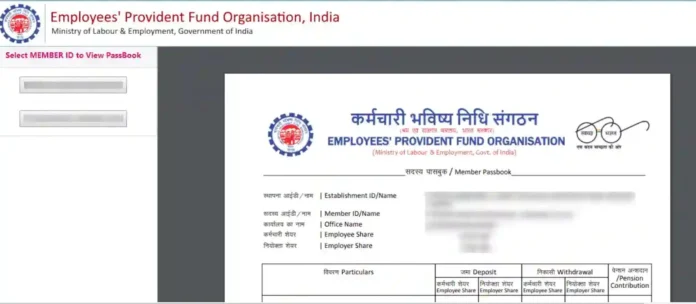

Via website

Go to the website of EPFO. Select ‘For Employees’ from the dropdown of ‘Our Services’. After this click on Member Passbook. Now login with the help of UAN Number and Password. Now choose PF Account and you will see the balance as soon as you open it.

Through UMANG App

You can also check PF balance through Umang App. For this, if you have a smartphone, open the Umang app and click on EPFO. Now click on Employee Centric Services and after that click on View Passbook and enter UAN and password. Enter the OTP received on the registered mobile number and your PF balance will be displayed.