EPF Tax deduction: If an employee contributes more than Rs 2.5 lakh in a financial year to the Provident Fund, then tax on interest received on deposits above Rs 2.5 lakh will have to be paid.

EPF Tax deduction: Interest received on money above Rs 2.5 lakh deposited in EPF account is now taxable. The new rule on Provident Fund Account has been notified with effect from 1st April 2022. Meaning that from April 1, 2022, the interest earned on the money deposited on your EPF account is being taxed. It has been kept as TDS-Tax Deduction at Source key. But, how is it calculated? It is important to understand this. How much and how will this affect you?

New math of tax on EPF interest?

The government has taken this step because of those who take more advantage of the Provident Fund account. A new provision was added in the Finance Act 2021. If an employee contributes more than Rs 2.5 lakh in a financial year to the Provident Fund, then tax will have to be paid on the interest earned on deposits above Rs 2.5 lakh. Suppose if Rs 3 lakh is in the account, then interest earned on additional Rs 50,000 will be taxed.

What is Rule 9D, in which there is talk of two provident funds

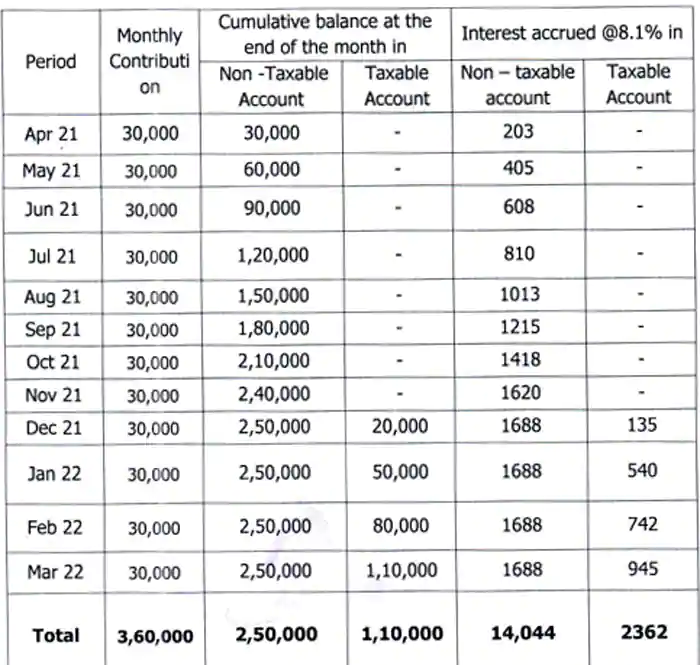

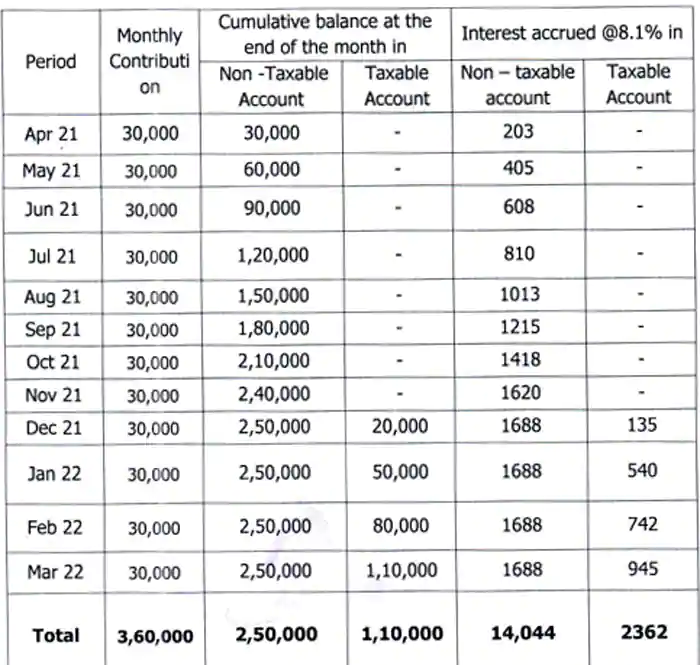

According to the new rules, now two accounts will be created in the Provident Fund. First- taxable account and second- non-taxable account. CBDT notified Rule 9D for this, in which tax will be calculated on the interest received on the Provident Fund contribution (Tax on EPF contribution). The new Rule 9D explains how the taxable interest will be calculated. Also how to manage two accounts and what companies will have to do.

Two provident fund accounts will be created

Now there will be two accounts in the Provident Fund. First- taxable account and second- non-taxable account.

Non-taxable: Understand that if someone has a deposit of Rs 5 lakh in his EPF account, then under the new rule, the amount deposited till March 31, 2022 will be deposited in the account without tax. There will be no tax on this.

Taxable: If more than Rs 2.50 lakh is deposited in one’s EPF account in the current financial year, then the interest received on the additional amount will come under the purview of tax. The rest of the money will be deposited in the taxable account for calculation on this. Tax will be deducted on the interest earned in it.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com