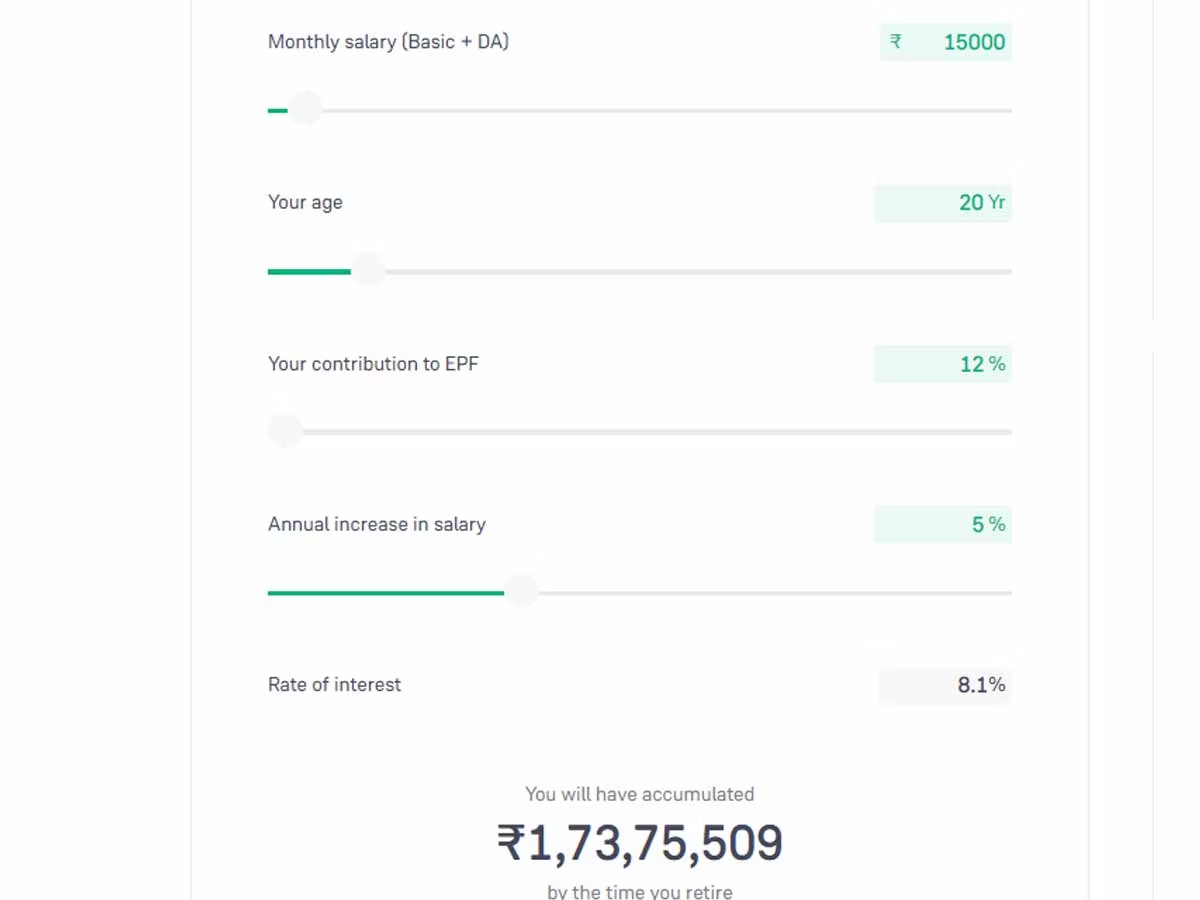

EPF Interest Rate: If we assume your basic salary as Rs 15000 and age as 20 years at the time of starting the job, then you will work for a total of 38 years at the age of retirement at 58 years. On the basis of this calculation, we will give you an idea of the strength of your PF account.

EPF Calculator: Some people also withdraw money from their provident fund i.e. PF along with changing jobs. But perhaps you are unaware of how much this mistake of yours could cost you in the future. Yes, if you also have the same habit then you are really playing with your future… and you may suffer a loss of crores of rupees due to this. How much benefit is there for you in keeping PF money in your account, if you also do the calculation then you will be surprised.

Account of 38 years of service

PF is the best way of saving money for salaried class. 12 percent of your basic salary is deposited in the PF account every month. At the time of starting the job, if we assume your basic salary to be Rs 15000 and your age to be 20 years, then you will work for a total of 38 years at the time of retirement at the age of 58 years. On the basis of this calculation, we will give you an idea of the strength of your PF account.

PF rule

If the basic salary of the employee is Rs 15000, then every month 12 percent of it (Rs 1800) will be deposited in the PF account from the employee side. Apart from this, as per rules the employer also contributes 12 percent. Out of this, 3.67% of basic salary (Rs 550) will be deposited in PF and the remaining 8.33% (Rs 1250) will be deposited in EPS. That means, apart from pension, Rs 2350 will be deposited in the employee’s PF account every month.

Rs 2350 will be deposited in PF account every month

At present the interest rate on PF is 8.15 percent. Earlier this rate was 8.10 percent. We calculate 38 years of employment at the rate of 8.10 percent only. If your salary increases by 5 percent every year in 38 years, then Basic and PF also increase in the same ratio. Suppose your basic salary is Rs 15000 and every month Rs 2350 is deposited in the employee’s PF account as per EPFO rules.

Rs 1.73 crore at the time of retirement

If this is calculated with an increment of 5 percent every year, then this amount remains less in the first 10 years. But the longer you save it, the more benefit you will get. According to Groww’s EPF Calculator, this amount will increase to Rs 1.73 crore on retirement. This calculation has been done on the basis of 8.1 percent per annum and increment of 5 percent every year.

Therefore, it is important to keep in mind that if you change your job, it is more beneficial for you to transfer the PF money instead of withdrawing it. You can merge it with your UAN. This is a very easy process. Money from PF account is usually allowed to be withdrawn after retirement. If you need money then try to manage it from somewhere else. But make every possible effort so that you do not have to withdraw PF money.

Apart from this, it is also worth keeping in mind that if it has been more than five years since your PF account was opened, then you will not have to pay any tax on withdrawing some amount from the deposited amount. But if your PF account has been open for less than five years, then tax will be deducted on your withdrawal of money.