Digital Form 16 is very easy to use. Using it, income tax returns can be filed without any mistake. Like the old Form 16, it also contains complete information about your salary, TDS and deductions.

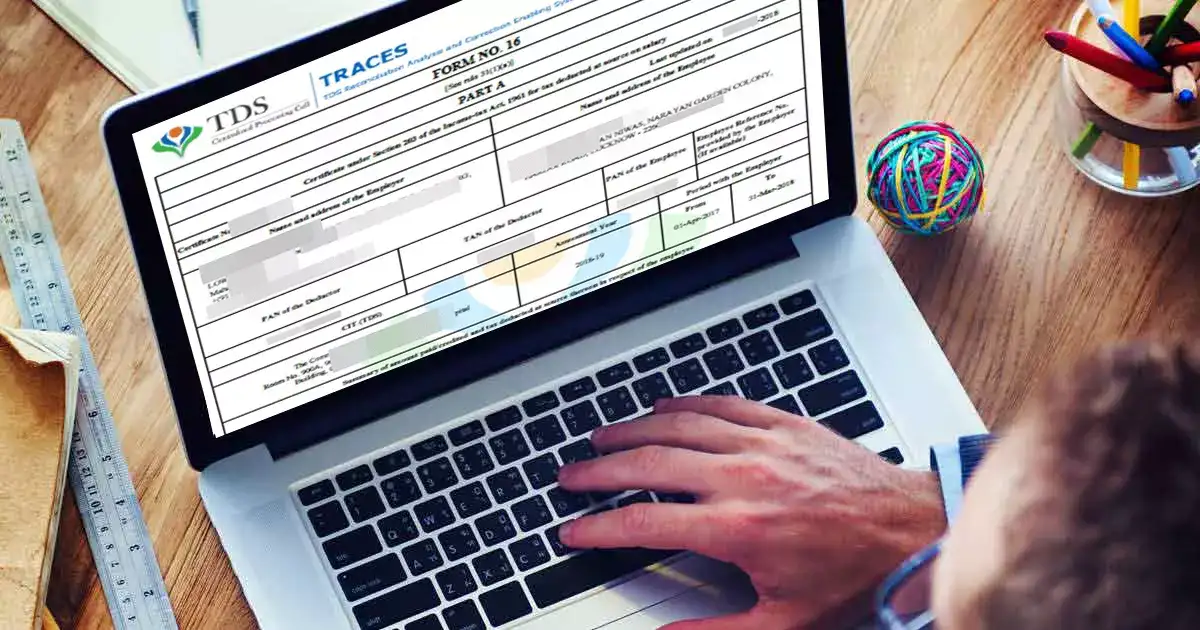

The season of filing Income Tax Return (ITR) has arrived. Employed people are waiting for Form 16 to be issued. Form 16 is necessary for filing returns of salaried taxpayers. Employers issue Form 16 to their employees. It contains many important information, which is very important for your income tax profile. Now employers are going to issue digital Form 16 to their employees.

This is how digital Form 16 is downloaded

Digital Form 16 is very easy to use. Using it, income tax returns can be filed without any mistake. Like the old Form 16, it also contains complete information about your salary, TDS and deductions. The question is where will you get Form 16? For this, employers can visit the official TRACES portal of https://www.tdscpc.gov.in. On this portal, employers can log in with Tax Deduction Account Number (TAN), password and captcha code. After logging in, you have to go to the ‘Download’ tab. Then select ‘Form 16’.

Employers have to provide these information

After selecting Form 16 on TRACES, the financial year has to be selected. After that, the PAN of the employees and other necessary information has to be entered. After that, the TDS receipt number, date of deduction and total deducted amount have to be entered. After this, click on Submit and Download Request. After this, your Form 16 will be downloaded. It can be used according to your need.

Employers will have to issue Form 16 by June 15

Form 16 has two parts – Part A and Part B. Part A contains information about the employer and employees. There is also a summary of the tax deducted. There is also information about the tax deposited with the government. Part B contains details of salary components, exemptions, deductions and total tax or refundable. It is easy for employers to issue Form 16 to employees by June 15. After this, the process of filing income tax return can be started.

How to use Form 16

Usually employers generate Form 16 using TRACES. After that they send it to all the employees. Filing income tax return has become very easy with the use of digital Form 16. The Income Tax Department’s platform automatically imports the salary details of the employees. It also imports the TDS and exemption details. After filing the income tax return with the help of these details, the e-verification process has to be completed using the Aadhaar OTP. This process can be completed through netbanking or by signing the ITR-5 and sending it to the centralized processing center.

Most Read Articles:

- HDFC Bank FD Interest Changed: Big news! HDFC Bank has changed the interest rates on FD, know what’s the new rate now

- Central Bank of India Recruitment 2025: Central Bank of India has released vacancy for 4500 apprentice posts, apply like this

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com