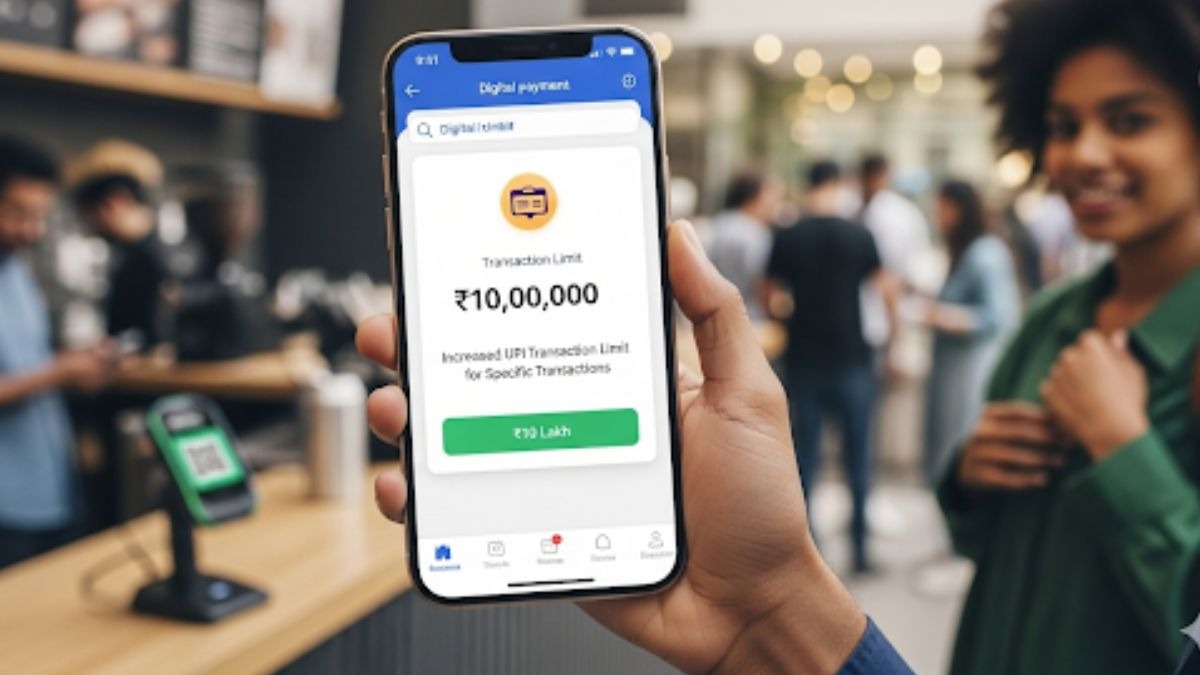

UPI Limit : There is great news for those making digital payments. The National Payments Corporation of India (NPCI) has increased the UPI transaction limits. The new limits will come into effect from September 15, 2025.

This will especially benefit those who have to make high-value payments like insurance premium, loan EMI, stock market investment, government fees or big travel bookings on a daily basis.

Where was the limit increased?

Capital Market and Insurance: Earlier the limit was 2 lakhs, now it has been increased to 5 lakhs per transaction. You can make payments up to 10 lakhs in a day.

Government e-marketplace and tax: Now transactions up to Rs 5 lakh can be done instead of Rs 1 lakh.

Travel Booking: Now tickets can be booked for up to Rs 5 lakh, instead of Rs 1 lakh; daily limit is up to Rs 10 lakh.

Credit card bill payment : Now payment up to Rs 5 lakh is possible at one time, but the daily cap has been kept at Rs 6 lakh.

Loan and EMI Collection : Now up to Rs 5 lakh per transaction and daily payment up to Rs 10 lakh can be made.

Jewellery Shopping: Rs 1 lakh to Rs 2 lakh per transaction, daily cap fixed at Rs 6 lakh.

Banking Services (Term Deposit): Limit on digital onboarding now up to ₹5 lakh, earlier ₹2 lakh.

Foreign Exchange Payment (BBPS) : Now transactions up to Rs 5 lakh, daily cap also Rs 5 lakh.

Digital account opening : The limit will remain at Rs 2 lakh as before.

On which transactions the limit has not changed?

This change will only apply to Person to Merchant (P2M) payments. That is, it will only apply to payments made to shopkeepers, companies or services. The Person to Merchant limit will remain the same as before at Rs 1 lakh per day.

Why is this change important?

With the new limits, users will not need to pay large amounts repeatedly in small installments.

Insurance premium or loan EMI can be paid in one go.

There will be ease in stock market and government fees.

Buying big ticket items or jewellery will also be possible through UPI.

Akash Sinha, CEO of Cashfree Payments, said that the decision to increase the UPI limit to Rs 5 lakh per transaction and Rs 10 lakh daily has come at the right time. Now traders will be able to provide digital checkout in a single click even for large payments and will also get instant settlement.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com