NPS pension rules: Insurance regulator ITRDAI has started the service of digital life certificate for NPS pensioners keeping in mind the convenience of senior citizens. Pensioners can now submit life certificate online with the help of Jeevan Pramaan.

NPS Subscribers: If you are a subscriber of the National Pension System, then this is great relief news for you. Insurance regulator IRDAI has issued a circular today, according to which NPS pensioners can now submit life certificate online. It has been said in this circular that insurance companies are directed to accept Aadhaar based authentication such as Jeevan Pramaan for life certificate verification. Jeevan Pramaan is a program run by the Government of India, which was started in the year 2014 keeping in mind the convenience of pensioners. This is a biometric enabled digital service for pensioners.

No need to fill separate proposal form

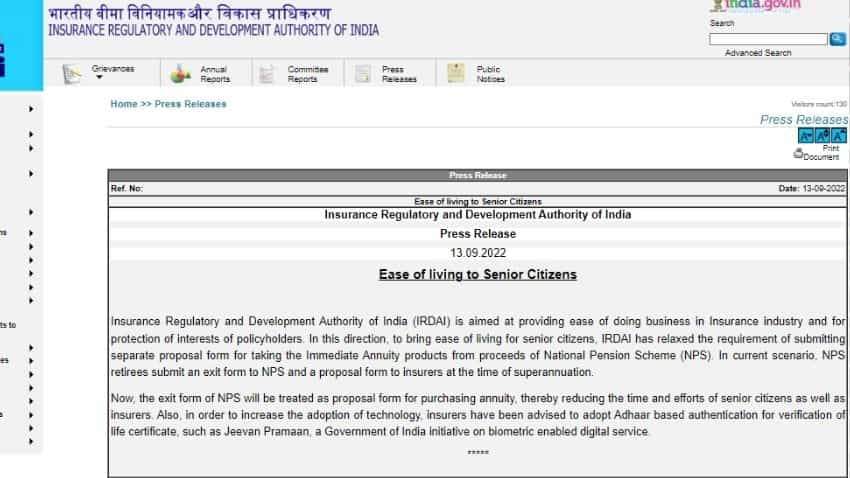

Apart from this, it is no longer mandatory for NPS subscribers to fill up a separate proposal form. The exit form submitted at the time of retirement will be considered as the proposal form. After retiring from this, pensioners will not have to face the hassle of running away. According to the IRDAI circular, this rule comes into force with immediate effect.

First you have to submit the exit form then the proposal form

Talking about the current rule, when an NPS subscriber retires, the pensioner has to submit the exit form to IRDAI at the time of withdrawal. After this, the pensioner has to fill the proposal form in detail which is offered by the insurance company. In the proposal form, the pensioners choose the annuity plan for themselves.

Exit form contains all the information

IRDAI said that in the exit form, pension fund regulator PFRDA seeks detailed information from pensioners. It contains all the information that the insurance company needs. In such a situation, there is no point in sharing the same information with the insurance company again for the pensioners. This is the reason that now the exit form will be considered as the proposal form.

It is necessary to buy an annuity of 40 percent corpus on retirement

As per the NPS rules, when a subscriber retires, it is necessary for him to buy an annuity plan at 40 per cent of the corpus. He can withdraw the remaining 60 percent in a lump sum. If the retirement corpus is less than 5 lakhs, then he can withdraw the entire amount. If a subscriber wants to exit this scheme before the age of 60 years, then he is required to buy an annuity of 80 percent of the total corpus from an insurance company. He can withdraw only a maximum of 20 percent in lump sum.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com