Finance Minister Nirmala Sitharaman’s announcement to acquire the first part of banks’ NPAs (Bad Bank) announced in the budget and efforts to settle the borrowings of the financial year 2007-12. A big step towards

Finance Minister Nirmala Sitharaman last week announced acquisition of the first tranche of Rs 90,000 crore of non-performing assets (NPAs) from banks by newly formed ‘bad bank’ National Asset Reconstruction Company (NARCL). The special thing is that he also announced a 5-year government guarantee program of Rs 30,600 crore for Security Receipts (SRs) issued by NARCL for the resolution of two lakh crore NPAs (1% of GDP). The properties will be transferred at an average recovery rate of 18 per cent. Of this, 15 percent (Rs 5400 crore) will be cash and 85 percent (Rs 306 billion) will be SR.

Center’s big step in the direction of settling the debt:

Finance Minister Sitharaman’s announcement of creating a bad bank in the budget for the financial year 2021-22 and the direction of the government’s efforts towards settling the borrowings during the financial year 2007-12 There is a big step in It can be understood here that Bad Bank is broadly an asset reconstruction company. Its job is to takeover the bad loans of the banks. Bad bank works to convert any bad asset into good asset.

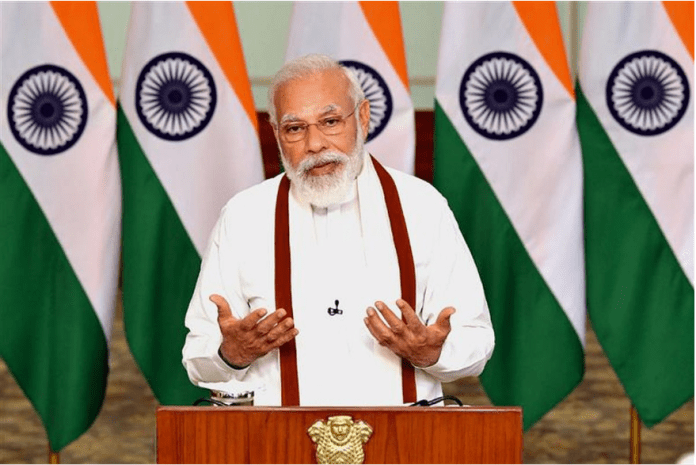

Modi government found bad banking system

When Prime Minister Narendra Modi’s government took over the reins of the country in 2014, he found a banking system that was on the verge of collapse. During the financial year 2007-12, a CAGR (compounded annual growth rate) growth of 20 per cent was registered in loans. According to the ‘House of Debt’ report of Credit Suisse for the financial year 2012-13, 13 percent of all loans taken from the banking system of the top 10 borrowers in the country were equal to 98 percent of the total net worth of the banking system. The average group debt EBITDA for the top 10 borrower group was 7.6 per cent. At the same time, four out of 10 had an interest cover of less than 1 per cent, which is an example of a bad balance sheet.

The banking system has been repaired in 7 years.

When the business did not get enough money to repay this loan, then this loan started turning into NPA. Troubled by this pressure in their balance sheets, the share of public sector banks in lending fell from 77 per cent to 65 per cent in 2018. In the last 7 years, the Modi government has made many efforts to fix the banking system. In this, special attention was given to recovery. Apart from this, the Insolvency and Bankruptcy Code (IBC) was also introduced. However, to deal with the disparity in NPAs that have arisen due to borrowers, there is a need for resolution on a large scale. That’s why a bad bank has been formed.

IDRCL will try to sell properties

India Debt Resolution Company Limited (IDRCL) will try to sell the stressed assets in the market. However, all banks have their own recovery departments, which specialize in handling such assets. In such a situation, jointly as an entity with a special team, the search for potential buyers, transfer of properties and new loan terms should be done expeditiously. Since the guarantee expires in 5 years, banks should be encouraged to accelerate. Giving SR instead of upfront capitalization of banks also prevents any near term impact on the fiscal deficit.

Recapitalization helps in preventing NPAs

In the last few years, the government has done recapitalization to help maintain the PSB balance sheet in view of the rising NPA burden. This recapitalization helped the banks to stop bad loans and various options were also explored to settle the cases. There has been so much misuse of lending during the last business cycle that even PSBs had to write off NPAs. After bringing regulators for public sector banks, solving the debt problem and devising many options for judicious use of capital, now the government is bringing NRCL.

Recognition of 85% outstanding loan on the basis of NPA

PSBs have recognized more than 85 per cent of the outstanding loans as NPAs. This is the process that started with the Asset Quality Review in 2016. If IDRCL can recover more than 15 per cent of the debt by managing the assets, it will increase the value of the PSBs by merging their existing stake holders. The professional management of IDRCL will assist him in this process. Therefore, NRCL is the last step in the chain of various initiatives, policy decisions, reforms and regulatory measures taken by the government in 2014. Not only this, now there is a need to change the thinking in the economic field as well.