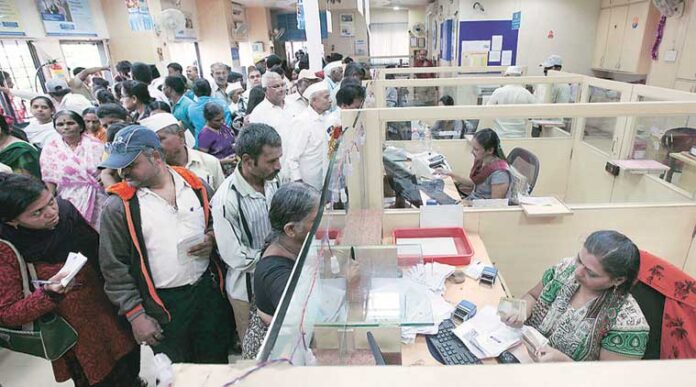

Post Office savings accounts: The Ministry of Communications said through a circular that the withdrawal of Rs 10,000 and above in the savings accounts of the post office branches will require verification.

Post Office savings accounts You can open a savings account in the post office, just like the savings account of the bank. Recently, the Department of Posts has changed the rules for withdrawing money from the Post Office Savings Account. These rules are applicable only on an amount of Rs.10,000 or more.

According to the Ministry of Communications in the circular issued on August 25, verification will be required for withdrawal of Rs 10,000 or more from savings accounts in any branch of the post office.

There will be no verification in these branches- Post Office savings accounts

It said that the verification of withdrawals of Rs 10,000 and above from Single Handed Post Offices has been done away with. An order dated 17 July 2018 has suggested verification for withdrawal only in the respective branch post offices. However, a note has been added under Rule 64 in the recent POSB CBS manual.

According to this notification, it is the special responsibility of the Circle Head to see that all necessary security measures and efforts to prevent fraud are carefully taken. Circle Heads are free to conduct any specific investigations they wish to do, depending on the local circumstances. The purpose of this verification is to minimize the fears of banking fraud.

Account holders can withdraw up to Rs 20,000 in a day

Apart from this, the postal department has also increased the withdrawal limit for its customers. Under the new rule, account holders can withdraw up to Rs 20,000 in a day at a branch of Gramin Dak Seva. Earlier this limit was Rs 5,000.

Know, how much can be the maximum transaction

Apart from this, no Branch Postmaster (BPM) will accept cash deposit transactions of more than Rs 50,000 in an account in a day. That is, cash transactions of more than Rs 50,000 cannot be done in one account in a day.

Deposit will be accepted only through check or withdrawal form

According to the new rules, apart from savings account, now through check deposits in Public Provident Fund (PPF), Senior Citizen Savings Scheme (SCSS), Monthly Income Scheme (MIS), Kisan Vikas Patra (KVP), National Savings Certificate (NSC) schemes. The acceptance or withdrawal will be done through the form.

4% annual interest is available on this scheme

Let us tell you that 4 percent annual interest is available on Post Office Saving Scheme. To open a savings account in the post office, you have to deposit only Rs 500. Even after this, it is necessary for you to maintain a minimum balance of Rs 500 in your account. If the amount in your account is less than Rs 500 then Rs 100 will be deducted as account maintenance fee.