Bank FD: If you also like to choose the option of Fixed Deposits for safe investment, then this news is of your use.

New Delhi. If you also like to choose the option of Fixed Deposits for safe investment, then this news is of your use. Some small private banks are giving returns of up to 7 percent on FDs. Please note that this special offer is for senior citizens.

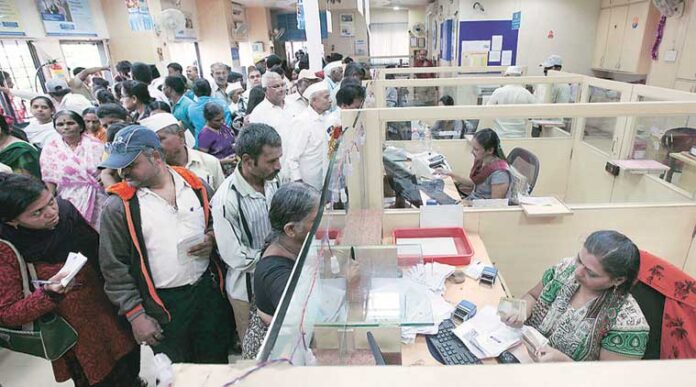

Senior citizens keep a part of their savings in fixed deposits. This gives them an opportunity to earn interest with good liquidity. However, at present most of the banks are not offering attractive interest on FDs.

Check Here Banks Interest Rates

>> Bandhan Bank is offering Senior Citizens up to 7 percent interest on FDs of three years.

>> Yes Bank is also offering senior citizens up to 7 percent interest on FDs of three years.

>> RBL Bank is also offering 6.8 percent interest to senior citizens on FDs of three years.

>> IDFC First Bank is offering 6.5 percent interest to senior citizens on FDs of three years.

>> DCB Bank is also offering 6.45 percent interest to senior citizens on FDs of three years.

>> Axis Bank is offering 6.05 percent interest to senior citizens on FDs of three years.

Know which bank is giving how much interest

>> Rs 1 lakh at the rate of 7% will be Rs 1.23 lakh in three years.

>> Similarly, Rs 1 lakh at 6.8 percent interest rate will be Rs 1.22 lakh in three years.

>> At 6.5 percent interest rate in three years it will become 1 lakh 1 lakh 21 thousand.

>> Investment of one lakh rupees at 6.05 percent interest rate becomes Rs 1.19 lakh in three years.

Small private banks are offering more interest on FDs to increase the deposit base. Deposit Insurance and Credit Guarantee Corporation gives a guarantee of up to Rs 5 lakh on investments in FD schemes. One of the safest investment options is fixed deposits, with tenor ranging from 7 days to 10 years.

FDs have a maturity period, you have to deposit money for that number of years. But this advantage is also that if needed, you can withdraw money even before time. Although you lose interest if you break the FD before maturity, some penalty has to be paid on it. Which is different in different banks.