If you want to start ATM business then you can take Hitachi ATM franchise. Let us know if you also want to start an ATM business, how much space will you need and how much money will have to be spent.

In today’s time, everyone wants to do a high earning business (Business Idea) by spending less money. If your house or shop is in a market where you feel there is scope for ATM, then you can earn huge income every month by installing an ATM there. Now UPI ATM has also been started, through which money can be withdrawn without ATM card. Rapid innovations regarding ATM are making it more attractive than before. There are different charges and commissions for different ATMs. If you want to start this business then you can take franchise of Hitachi ATM. Let us know if you also want to start an ATM business, how much space will you need and how much money will have to be spent.

How much will have to be invested?

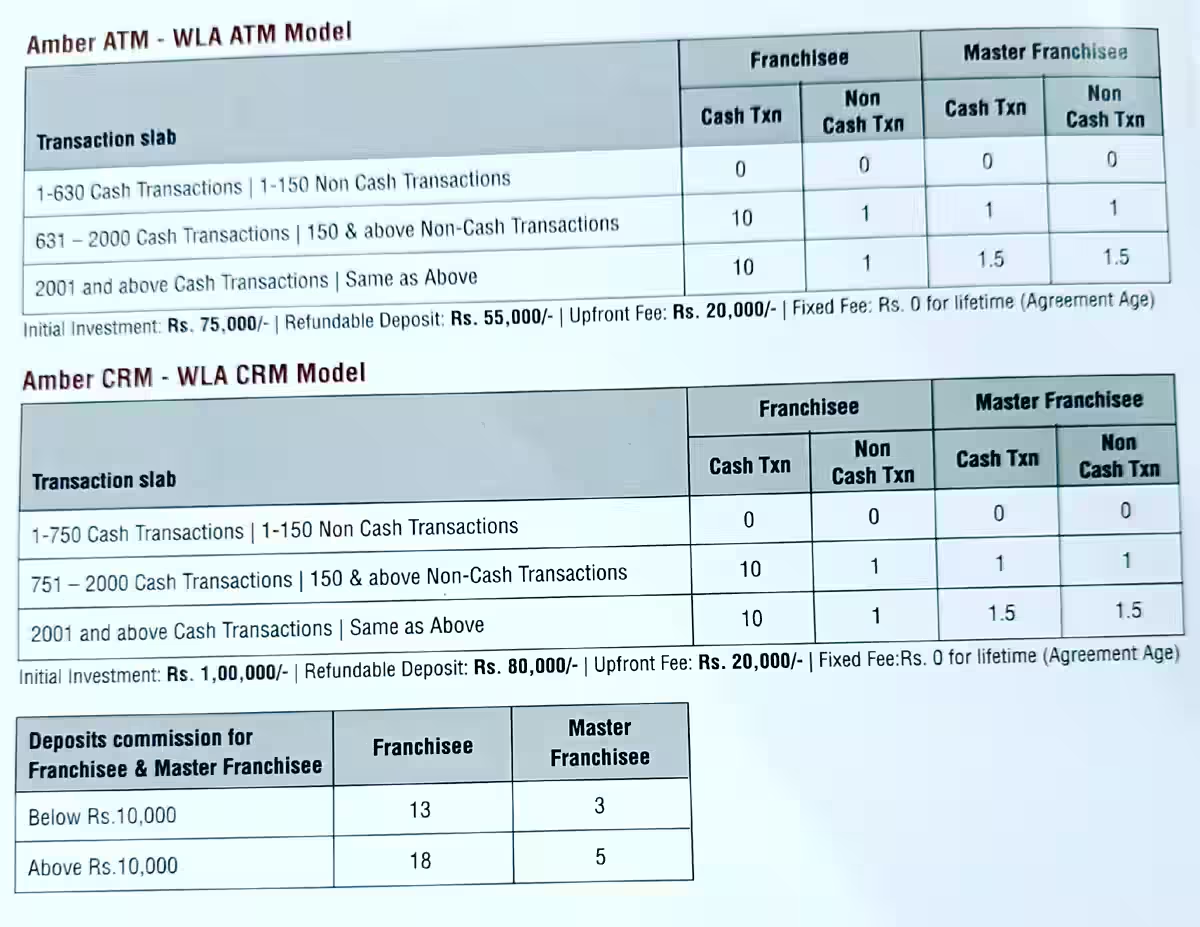

According to Hitachi ATM, if you want to start a business by taking its franchise, then you will have to invest around Rs 1.5 lakh. However, about Rs 1 lakh is refundable in this, while Rs 50 thousand is the fee. Cash can be withdrawn from this ATM and cash can also be deposited in it. Whereas if you install an ATM only for cash withdrawal, then you will have to deposit Rs 1.25 lakh for it. In this, Rs 75 thousand will be refundable, while a fee of Rs 50 thousand will be charged.

How much profit will there be?

The company claims that you can easily earn up to Rs 50 thousand per month through cash and non-cash transactions from this ATM. Under the company’s Pearl ATM business model, there are many slabs of earnings and money is paid according to them. You will not get any money for 700 cash transactions up to Rs 2001. However, up to 701-1400 cash transactions, you will get Rs 7 per transaction. Up to 1401-2000 transactions you will get Rs 8.5 per transaction. You will not get any money on transactions more than 2001. Keep in mind that all these transaction numbers are only for the value up to Rs 2001.

If your ATM transactions are more than Rs 2001, then up to Rs 700 you will get Rs 4 per transaction. Whereas on 701-1400 transactions, Rs 8 per transaction will be available. Not only this, till 1401-2000 transactions you will get Rs 9.5 per transaction. For more than 2000 transactions, you will get Rs 10.5 per transaction.

Even if there are non-cash transactions through your ATM, you will still earn money. You will get Rs 1 per transaction up to 1400 non-cash transactions. And on more than 1400 non-cash transactions, you will get Rs 2 per transaction. This earning is just an idea. Earnings on different types of ATMs are also different.

Who can take this franchise?

To take Hitachi ATM franchise, you must have a space of about 40-60 square feet. Besides, it is also important that where your shop is located, a lot of people keep coming and going there every day. That means your shop should be in a crowded market.

Hitachi Money Spot ATM is a white label brand of Hitachi Payment Services. Hitachi Payment Services manages about 65,500 ATMs for all major banks. The company has more than 9300 white label ATMs across the country. It has received license and approval from the Reserve Bank of India. Hitachi has ATMs in 29 states and 6 union territories. It has ATMs in more than 570 districts and 4300 towns of the country. This company also provides master franchise, under which you earn more and other franchises are opened in nearby areas under you.