Asset managers net dumped Jubilant FoodWorks the most in the mid-cap space last month.

Mumbai: Amid the selloff in the market in May, mutual funds have dumped the consumption-linked stocks directly impacted by Covid-19, the most in the mid-cap space along with financials.

In the month of May, while Sensex dropped 3.84 per cent, BSE Mid Cap index and BSE Small Cap index shed 1.42 per cent and 1.88 per cent respectively.

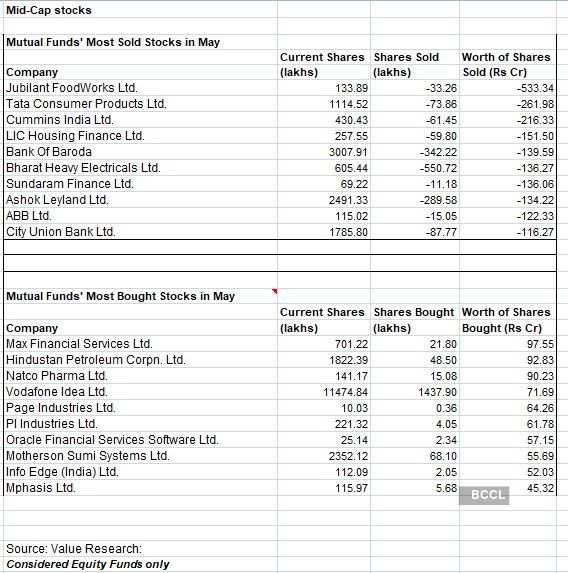

Asset managers net dumped Jubilant FoodWorks the most in the mid-cap space last month, as they sold a net of Rs 533.34 crore worth of the quick service restaurant (QSR) chain, data from mutual fund tracker Value Research showed.

Jubilant FoodWorks—which operates the Domino’s and Dunkin’ Donuts chain of pizza and coffee shops in India—posted a 71.5 per cent drop in fourth quarter standalone net profit at Rs 21 crore.

On May 21, HDFC Securities cut its rating on Jubilant FoodWorks to reduce from add.

“QSR will be among the most impacted categories in FY21 as dine-in pressure will be immense,” HDFC Securities said in the report.

“We continue to believe that Jubilant is one of the strongest QSR players (superior store economics, healthy FCFs (free cash flows), strong balance sheet) and will be able to gain market share. However, high impact on OOH (out of home) consumption will have several challenges for growth (co is also returning to muted store expansion in FY21),” it added.

Tata Consumer Products Ltd, was the second-most sold mid-cap stock, as they sold Rs 261.98 crore of the stocks. Tata Consumer Products Ltd (TCPL) reported a net loss of Rs 122.48 crore for the March quarter. The company, earlier known as Tata Global Beverages Ltd, had posted a net profit of Rs 35.99 crore in the January-March period a year ago.

“These stocks had rallied a lot before the lockdown, and these stocks were directly impacted by the lockdown, leading to unfavourable valuations,” said Rusmik Oza, head of fundamental research at Kotak Securities.

Investors have largely turning cautious on mid cap stocks, with net inflows into mid cap funds dropped to a measly Rs 279 crore in May, the lowest in the past 14 months and also lower than the inflows into small cap funds during the month.

The share of mid cap inflows to the total equity inflows shrank to 5.3 per cent, compared to an average of 20.5 per cent in the past one year.

“People have moved money to bigger and quality names. Fund managers would like to play safe with the current stress in the market,” said Oza.

Among the other top stocks that fund managers sold in May, financials were key.

In the financials pack, fund managers sold LIC Housing Finance, Bank of Baroda, Sundaram Finance, City Union Bank.

“NBFCs (non-banking finance companies) are going to face a lot of headwinds. As compared to banks, they will be in a precarious position. Even the top names aren’t spared from the selloff,” pointed Oza of Kotak.

Apart from these, they dumped Cummins India, Bharat Heavy Electricals (BHEL), Ashok Leyland and ABB.

On May 11, Anand Rathi Share & Stock Brokers recommended a sell on Cummins India.

“We expect capex generally to be severely constricted and FY21 to be a washout from both ordering and execution perspectives due to the Covid-19 pandemic,” Anand Rathi said in the note.

On June 14, Motilal Oswal downgraded BHEL to sell saying any visible sign of improvement is still some time away.

“While orders are few to come by, the pricing environment remains highly competitive, limiting scope for margin expansion,” Motilal Oswal analysts said.

“We expect the company’s recent expression of diversification to materialize with a certain time lag owing to the subdued economic environment,” they added.

The downcycle in capex ensured many other capex players were off investors’ radar.

On May 15, HDFC Securities maintained it sell rating on ABB.

Also Read: China Threatens US Of “Consequences” After Trump Signs Law On Uighurs

“ABB business model remains highly sensitive to demand outlook. We see challenging 2QCY20 and slow ramp-up for 2HCY20. With clients conserving capital and global growth outlook bleak, capex headwinds remain,” HDFC Securities said in the note.

Mutual funds’ top buys in the mid cap space in Mauy were of much lower value than the top sells in the space, data showed.

Among the top buys, they lapped up Rs 97.55 crore worth of Max Financial Services, Rs 92.83 crore of Hindustan Petroleum Corporation (HPCL), and Rs 90.23 crore of Natco Pharma.