In spite of few concerns, sovereign bonds in India are poised to advance after economic growth slumped to a six-year low, bolstering bets for deeper interest-rate cuts

During the last year, the Indian equity market remained highly volatile impacted by back-to-back domestic and global cues.

Starting from the Long Term Capital Gains (LTCG) for equity gains introduced in Budget 2018, the reclassification of mutual funds by SEBI, US-China trade war, corporate frauds and governance issues such as PNB bank, IL&FS crisis, NBFC crisis and liquidity crunch in the whole financial system, and economic slowdown, have kept the market under its grip.

The September 20 tax cut announcement by the government helped markets to relief from the ongoing bleeding.

But again, Indian benchmark indices posted its fifth consecutive day of losses on Friday, as shadow banking crisis has sucked in more financial firms eroding a stock market rally that’s been driven by a surprise $20 billion tax cut package.

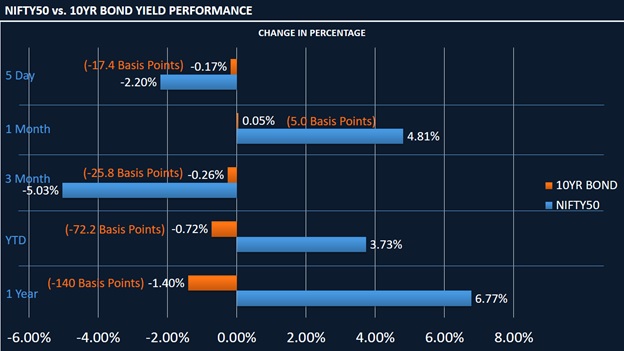

The benchmark index Nifty50 has given positive return of 6.77 percent return over a year. But it had lost 5.03 percent over the last three months and erased value of 3 percent in last 5 days.

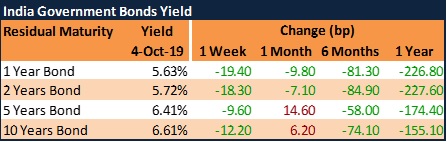

Meanwhile, the yield on the benchmark India 10 year’s government bond (6.614 percent yield on October 3, 2019) changed -9.6 bps during last week, +5.0 bps during last month, and -140 bps during last year.

In the past, the India 10 Years Government Bond reached a maximum yield of 8.182 percent on September 11, 2018.

Under volatile market conditions and decreasing interest rate regime, one should consider investing in select safe debt instruments such as government bonds, corporate bonds, short term money market instruments, debt mutual funds as a part of their portfolio.

The bond yield is inversely related to its price, in last one year the G-Sec 10 year bond yield has decreased by 140 basis points, as a result the overall bond prices has increased significantly.

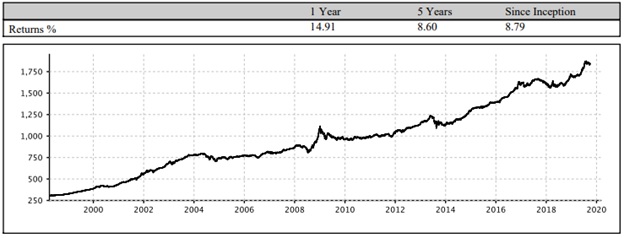

The NIFTY 10 year Benchmark G-Sec index, which replicates the 10 year bond return, has given 14.91 percent return in last one year. The 5-year return is 8.60 percent while it has 8.79 return since inception in 1998.

The NIFTY 10 yr Benchmark G-Sec Index Performance:

Way ahead for bond market:

This year the central bank has slashed rates six times in an attempt to spur growth. Another 50 basis points of rate cuts may be on the way.

The economy grew 5 percent in the three months up and till June, missing the estimate of economists. The economic revival process is likely to be gradual and weak at first. Data released since the GDP print suggests that the slowdown persists.

The nation’s manufacturing purchasing managers’ index slipped in August from a month ago, while collections from the goods and services tax also eased. All these factors may be remain a headwind for equity markets at least for few more quarters until the economy and corporate earnings will revive its growth.

Reduction in interest rate has benefited the debt holders as their bond prices increases with decreasing interest and exposure to fixed income securities during the next two to three quarters will provide a cushion against equity investment volatility.

In spite of few concerns, sovereign bonds in India are poised to advance after economic growth slumped to a six-year low, bolstering bets for deeper interest-rate cuts. The current economic slowdown, low inflation and a change in the monetary policy stance suggests that the interest rates will continue to remain low in the short term.

It is advisable to invest in debt securities, such as G-sec 10-year bond to have a relatively lower volatility and interest rate risk in your portfolio. Investors need to have a balanced portfolio under both increasing and decreasing interest rate trends as per their risk appetite and financial goals.

Well diversification by investment allocation in different asset classes including equities and safe assets class such as debt instruments and fixed deposits can help to create as well as protect wealth.

(The author is Director at Wealth Discovery/EZ Wealth.)