What will be your new net salary with ₹1,82,200 basic salary at HAG level (AGP_15) in the 8th Pay Commission? Know the complete calculation with fitment factor 1.92, DA, HRA, TA.

8th Pay Commission Salary Calculator: The wait for the formation of the 8th Pay Commission and its recommendations for central government employees has now intensified. Every employee, irrespective of his level, is eager to know how much his salary will increase. This time we will discuss the possible salary of officers of High Administrative Grade (HAG) i.e. level AGP_15, whose current basic salary is ₹1,82,200. What will be the new basic-pay? How much will the fitment factor be? And what will be the total net salary after adding HRA (house rent allowance) and TA (travel allowance) to all this? Let us find the answers to all these questions and understand the entire calculation through an estimated ‘8th CPC Salary Calculator’.

How important is the Fitment Factor?

The fitment factor plays a decisive role in revising the basic salary of central employees in the new pay commission. Let us remind you that in the 7th Pay Commission it was 2.57, which increased the minimum salary from ₹ 7,000 to ₹ 18,000 directly. Many speculations are being made about the fitment factor for the 8th Pay Commission, such as 1.92, 2.08, or 2.86.

It is believed that on the lines of the old pay commissions, the government can keep the fitment factor around 1.90 or 1.92 in the 8th Pay Commission as well. Since the 8th Pay Commission fitment factor has not been officially announced yet, we will do our calculations based on a possible fitment factor of 1.92.

What could be the salary at HAG level (AGP_15)?

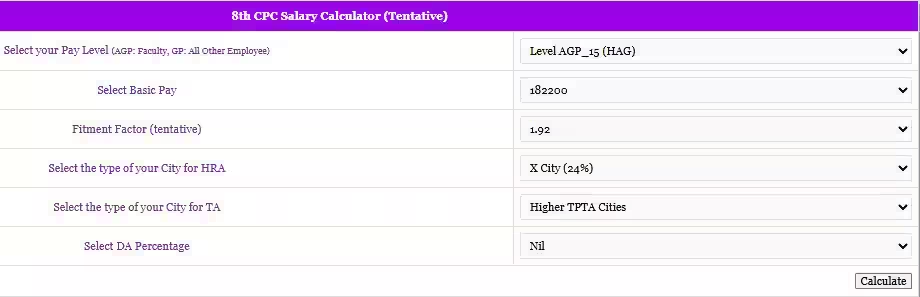

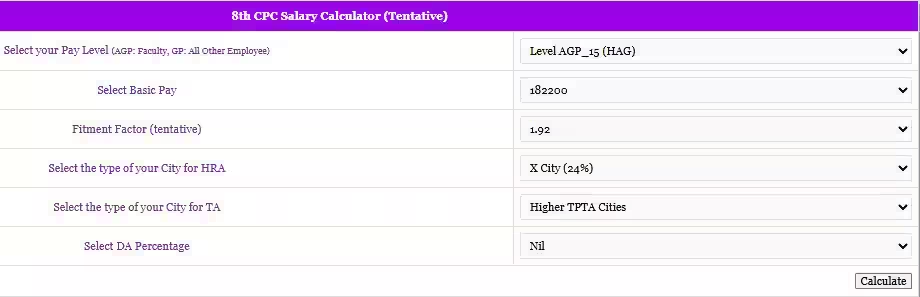

Let us now see how the estimated new salary of an officer with a basic salary of ₹1,82,200 at level AGP_15 (HAG) may look like in the 8th Pay Commission (potentially effective from January 2026):

8th CPC Salary Calculator (Expected – Level AGP_15)

| Parameters | Price/Description |

| Your Pay Level | AGP_15 (HAG) |

| Current Basic Pay | ₹1,82,200 |

| Fitment Factor (Approximate) | 1.92 |

| City Category for HRA | X-City (24%) |

| City Category for TA | Higher TPTA Cities |

| DA (Beginner) | Zero |

| Constituent | Amount (₹) |

| Your Pay Level | AGP_15 |

| Basic Pay | 1,82,200 |

| Revised Basic Pay (with fitment factor) | 3,49,824 |

| DA (Dearness Allowance) | 0 |

| HRA (House Rent Allowance) | 83,958 (24% of 3,49,824) |

| TA (Travelling Allowance) | 7,200 |

| Other allowances/income (if any) | 0 |

| Gross Salary | 4,40,982 |

| —Deductions— | |

| NPS Contribution (10% of Revised Basic) | 34,982 |

| CGHS Contribution | 1,000 (approximately) |

| Income Tax (New Regime FY: 2025-26) (Approx) | 99,236 (based on annual ₹11,90,836) |

| Other deductions (if any) | 0 |

| Total Deductions | 1,35,218 |

| Net Salary | ₹3,05,764 (approx.) |

Understand the calculation carefully

1. Revised Basic Pay

- Current Basic Pay (₹1,82,200) * Fitment Factor (1.92) = ₹3,49,824

2. Dearness Allowance (DA)

- As is the case at the beginning of every new Pay Commission, DA will be reduced to zero (0). Thereafter, it will increase as per the rates announced by the government from time to time.

3. House Rent Allowance (HRA)

- For class X cities, HRA is 24% of the revised basic pay.

- ₹3,49,824 * 24% = ₹83,957.76 (approximately ₹83,958)

4. Travel Allowance (TA)

For higher level officers for Higher TPTA cities it is ₹7,200 (when DA is Nil) + DA as applicable (which will be Nil initially).

5. Gross Salary

- Revised Basic Pay + DA + HRA + TA = ₹3,49,824 + ₹0 + ₹83,958 + ₹7,200 = ₹4,40,982

6. Deductions

- NPS Contribution : 10% of Revised Basic Pay = ₹3,49,824 * 10% = ₹34,982.4 (approximately ₹34,982)

- CGHS Contribution : This is a fixed amount which varies as per the salary level (for example ₹1000).

- Income Tax : This is the estimated monthly deduction calculated based on annual income and applicable tax slab (new system). Monthly deduction is ₹99,236 based on annual tax of around ₹11,90,836.

7. Net Salary

- Gross Salary – Total Deductions = ₹4,40,982 – (₹34,982 + ₹1,000 + ₹99,236) = ₹3,05,764

Will DA really become zero?

Yes, this is a standard procedure. With the introduction of every new pay commission, the existing dearness allowance is incorporated in the new basic pay (or the fitment factor is taken into account) and then the DA calculation starts from zero. Currently, under the 7th Pay Commission, DA has crossed 50% (for example if it is 55% or more), but in the 8th Pay Commission it will be zero initially and then the government will increase it at regular intervals based on the All India Consumer Price Index (AICPIN) data.

Recommendations and the final decision of the government

The above calculation is based on an estimate, assuming a fitment factor of 1.92. The final decision on the actual fitment factor, status of DA (though likely to be zero), and other allowances will depend on the recommendations of the government and the 8th Pay Commission. Nevertheless, it is clear that officers working at level AGP_15 (HAG) may see a huge jump in their salaries.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com