8th CPC Salary Calculator: How much money will come in the pockets of Level-1 (GP-1800) employees? What will be the new basic pay? How much will be the fitment factor? And what will be the total net salary after adding HRA (House Rent Allowance) and TA (Travel Allowance) to all these?

8th CPC Salary Calculator: The wait for the 8th Pay Commission for central government employees now seems to be a guest of just a short time. Everyone has the same question in their mind that how much will their salary increase. Especially how much money will come in the pockets of Level-1 (GP-1800) employees? What will be the new basic pay? How much will be the fitment factor? And what will be the total net salary after adding HRA (House Rent Allowance) and TA (Travel Allowance) to all these? If all these questions are roaming in your mind too, then we will clear all your curiosity. Today we will tell you that we have also brought ‘8th CPC Salary Calculator’ for you, so that you can see the complete calculation of your estimated increased salary yourself. So let’s know how much the new salary will be.

How much will be the Fitment Factor?

The Fitment Factor plays the most important role in deciding the basic salary of central employees. In the 7th Pay Commission, it was 2.57, due to which the minimum salary increased from ₹ 7,000 to ₹ 18,000. Now there are different estimates regarding the fitment factor in the 8th Pay Commission – 1.92, 2.08 and 2.86. This will decide how much the new salary of the employees will be. In the 8th Pay Commission, there is a possibility of keeping the fitment factor around 1.90 or 1.92 on the lines of the old pay commissions. The fitment factor of the 8th Pay Commission has not been decided yet, hence the calculation in the calculator is based on the possible fitment factor (calculation at 1.92).

What can be the salary in the 8th Pay Commission?

| Pay Level | 7th Pay Commission (Basic Pay) | 1.92 fitment factor | 2.08 Fitment Factor | 2.86 fitment factor |

|---|---|---|---|---|

| Level 1 | ₹18,000 | ₹34,560 | ₹37,440 | ₹51,480 |

| Level 2 | ₹19,900 | ₹38,208 | ₹41,392 | ₹56,914 |

| Level 3 | ₹21,700 | ₹41,664 | ₹45,136 | ₹62,062 |

| Level 4 | ₹25,500 | ₹48,960 | ₹53,040 | ₹72,930 |

| Level 5 | ₹29,200 | ₹56,064 | ₹60,736 | ₹83,512 |

| Level 6 | ₹35,400 | ₹67,968 | ₹73,632 | ₹1,01,244 |

| Level 7 | ₹44,900 | ₹86,208 | ₹93,392 | ₹1,28,414 |

| Level 8 | ₹47,600 | ₹91,392 | ₹99,008 | ₹1,36,136 |

| Level 9 | ₹53,100 | ₹1,01,952 | ₹1,10,448 | ₹1,51,866 |

| Level 10 | ₹56,100 | ₹1,07,712 | ₹1,16,688 | ₹1,60,446 |

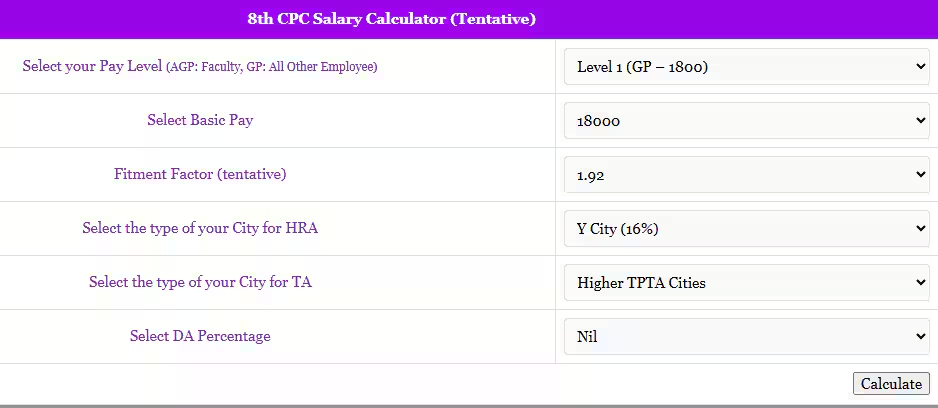

| 8th CPC Salary Calculator (Tentative) | |

|---|---|

| Select your Pay Level (AGP: Faculty, GP: All Other Employee) | |

| Select Basic Pay | |

| Fitment Factor (tentative) | |

| Select the type of your City for HRA | |

| Select the type of your City for TA | |

| Select DA Percentage | |

| Salary from January 2026 (per month) | |

|---|---|

| Your Pay Level | |

| Basic Pay | |

| Revised Basic Pay ( with fitment factor) | |

| DA ( Dearness Allowance) | |

| HRA (Hourse Rent Allowance) | |

| TA (Travelling Allowance) | |

| Other Allowances/Incomes (if any) | 0 |

| Gross Salary | |

| NPS Contribution | |

| CGHS Contribution | |

| Income Tax (New Regime FY:2025-26) (approx) per annum | (approx) |

| Other Deductions (if any) |

0 |

| Net Salary | |

Now let us understand the calculation

According to the calculator, we have also done the calculation on the lowest grade in the 8th Pay Commission. Level-1 grade pay is 1800, the basic pay in this grade is Rs 18000. After this, the fitment factor in it is considered to be 1.92. HRA has been taken as per the Y category. There is also a possibility of revision in this. Therefore, it has been kept at 16%. Travel allowance (TA) has been calculated according to the higher TPTA city. If you see, the total gross salary is Rs 41440. But, this will not be the final salary. Because, government employees will also have to give NPS contribution and CGHS contribution. After salary revision, the contribution to NPS will be Rs 3456 and Rs 250 will go to CGHS. In this sense, the net salary on one grade pay will be Rs 37734. In this, dearness allowance i.e. DA has been kept zero. Because, it will be made zero when the new pay commission is implemented.

Will DA become zero?

In every new pay commission, the Dearness Allowance (DA) is reset at the beginning. Currently, the DA in the 7th Pay Commission is 55%. After this, there may be an increase of 2% in July. But, in the 8th Pay Commission, it will be reset from zero and then increased at regular intervals.

Most Read Articles:

- Credit Card Charges Change: Kotak Mahindra Bank announced changes in credit card charges, check new charges here

- ITR Filing without Form 16 : Big News! You can File Income Tax Return without Form 16, know process here

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide