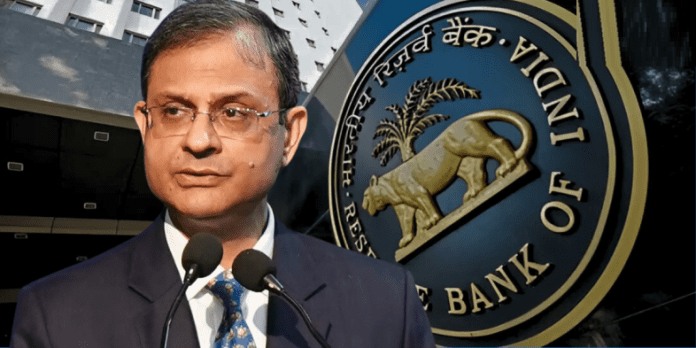

RBI Repo Rate EMI: RBI Governor Sanjay Malhotra has reduced the repo rate. This will provide relief to home loan customers. The EMI of their loan will be reduced.

RBI announced the monetary policy on 6th August at 10 am. Central Bank Governor Sanjay Malhotra did not announce a reduction in the repo rate. This means that the repo rate will remain at 5.50 percent. Earlier, he had announced a 50 basis point reduction in the repo rate in the June monetary policy. In the April policy too, the central bank had reduced the repo rate by 25 basis points. Earlier, there was a reduction in February too.

A reduction in the repo rate is good news for home loan customers. There is some disappointment over the fact that there was no reduction in it. A reduction in the repo rate was expected in August. Most analysts believed that the central bank would reduce the interest rate on August 6. But, RBI did not do so. RBI’s monetary policy meeting started on August 4. After a three-day meeting, its results came on August 6.

RBI Governor Sanjay Malhotra said that the central bank’s focus will remain on growth. But, the existing home loan customers have been disappointed due to the repo rate not being reduced. Also, those who were waiting for a reduction in the repo rate to buy a home loan and a car have been disappointed.

After RBI reduces the repo rate, banks reduce the interest rate of all types of loans including home loans and car loans. This makes it cheaper for customers to take loans. Their EMI of the loan remains low. This year RBI has reduced the repo rate thrice. This has reduced the EMI of home loans and car loans. But, customers were expecting a reduction in the repo rate once again in August.