PM SVANidhi Scheme: Modi government’s big gift for street vendors! PM SVANidhi scheme extended till 2030, now you will get first loan of ₹ 15,000 and UPI credit card. Know the new changes and benefits.

A very big and relieving news has come for the crores of street vendors of the country, who work hard day and night to fulfill our and your needs on the streets of the cities. A historic decision has been taken regarding the ‘PM SVANidhi’ scheme in the Union Cabinet meeting chaired by Prime Minister Narendra Modi.

The government has not only extended this superhit scheme till March 2030, but has also made such wonderful changes in it that it has now become a life-changing scheme for street vendors. Now they will not only get more loans than before to expand their business, but for the first time they will also get the power of UPI-linked RuPay Credit Card.

What is PM Swanidhi Yojana?

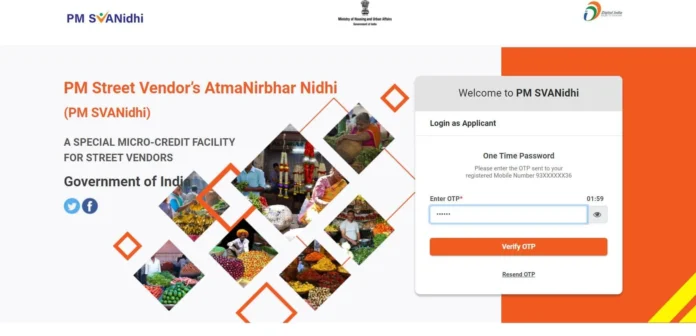

First of all, it is important to know what this scheme is. When the lockdown was imposed during the Corona epidemic, these street vendors were the worst hit. Their business was completely ruined. In such a situation, on June 1, 2020, the Modi government started the ‘PM Street Vendors Atmanirbhar Nidhi’ (PM SVANidhi) scheme to help them. Its purpose was to free the street vendors from the expensive loans of moneylenders and get them a small loan (working capital) from banks on very easy terms, so that they can start their work again.

What are the major changes now?

1. Now you will get more loan than before

First loan: Till now, the first loan amount was ₹10,000. Now it has been increased to ₹15,000. Second loan: After repaying the first loan on time, the amount of the second loan has been increased from ₹20,000 to ₹25,000. Third loan: The amount of the third loan will remain the same as before i.e. ₹50,000.

2. The biggest game changer – now you will get a credit card

This is the most revolutionary step of this scheme. Those beneficiaries who successfully repay their second loan will now be given UPI-linked Rupay credit card by the banks. This will enable them to get money immediately for sudden business or personal needs. Now they will not need to beg in front of anyone.

3. You will get reward (cashback) on digital shopping

To promote Digital India, the government will now reward these small traders on digital transactions. Street vendors will be able to get cashback of up to ₹1600 on retail and wholesale transactions.

4. Now the scheme will reach villages and towns

This scheme will no longer be limited to big cities. The government will gradually implement it in census towns and peri-urban areas as well.

Not just loan, the whole family will get benefit

The aim of the government is not just to give loans but also to bring about holistic development of these hardworking people and their families. For this, the ‘Swanidhi se Samriddhi’ campaign will be further strengthened. ‘Lok Kalyan Melas’ will be organised every month to ensure that these beneficiaries and their families also get full benefits of other schemes of the government (such as Ujjwala Yojana, Ayushman Bharat, PM Awas Yojana etc.).

Apart from this, people who sell food items will also be given special training on hygiene and food safety in collaboration with FSSAI.

Success story so far

You can guess how successful this scheme has been from these figures. As of July 30, 2025, more than 96 lakh loans have been distributed to more than 68 lakh street vendors, with a total amount of ₹ 13,797 crore. About 47 lakh beneficiaries are digitally active and have done more than 557 crore digital transactions. This scheme has also received big honors like ‘Prime Minister Excellence Award’ (2023) and ‘Excellence Award for Digital Transformation’ (2022) for its success.

Conclusion

The extension of PM Swanidhi Yojana till 2030 and the changes made in it is a masterstroke of the Modi government. This step will not only empower the smallest traders of the country financially, but will also bring them into the mainstream of the digital economy. The facility of credit card and increased loan will make them an important partner in the creation of a self-reliant India by taking them out of the clutches of moneylenders.