Income Tax e-pay: e-pay is a digital gateway of the Income Tax Department, which makes the process of tax payment very easy. Taxpayers can easily pay their tax using this feature. The use of this system is completely safe

It is necessary for taxpayers to deposit tax to the Income Tax Department within the stipulated time. Failure to do so may result in penalty, notice may come and interest may have to be paid on tax. The last date for filing income tax return for the financial year 2024-25 is 31st July. The process of filing returns will start as soon as the Income Tax Department releases utilities and ITR forms. Before this, it is important for taxpayers to know about the e-feature of Income Tax.

What is the e-pay feature of Income Tax Department?

e-pay is a digital gateway of the Income Tax Department, which makes the process of tax payment very easy. Taxpayers can easily pay their tax using this feature. The use of this system is completely safe. The tax money reaches the Income Tax Department immediately. A taxpayer can use the e-pay feature for tax payment through net banking, debit card, NEFT/RTGS etc.

How can the e-feature be used?

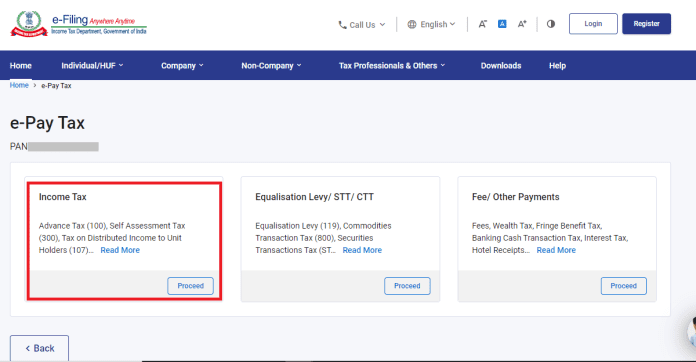

To use the e-pay feature, you have to go to the e-filing portal of Income Tax. After logging in with your ID and password, you will see this feature in the quick link on the home page. After clicking on this feature, you have to enter your PAN and mobile number. After this, a six-digit OTP will come on your mobile phone. As soon as you enter it, your verification will be completed. After that you have to select the type of payment. After that you have to select the financial year. Then you have to select the payment mode and bank. After that, your payment will be done as soon as you click on Pay Now.

Using e-pay is completely safe

Experts say that e-pay is the easiest way to pay income tax. It is also safe. There is almost no chance of transaction failure. Taxpayers are assured that their tax money will reach the Income Tax Department immediately. Taxpayers can file their income tax returns within the deadline and use the e-pay feature for tax payment. This will save the taxpayer from paying penalty and interest on tax.

Most Read Articles:

- New Amrit Bharat train: Good news! 4 new trains including Amrit Bharat train will be started on 24 April, check routes & other details

- Income Tax: New update came! Good news for Taxpayers! Now you will not have to pay tax even on salary of 17 lakhs.

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide