Digital Form 16 Benefits : This step is not only a relief for the common people, but will also make the work of the tax department easier. Now neither the refund will come late, nor the stress of notice. Next time while filing ITR, remember that Digital Form-16 is your new companion.

Benefits of Digital Form 16: Think, how much effort it takes to keep track of your salary, TDS and tax saving deductions for the whole year? Even then, some mistake or the other happens while filing ITR, but now the Income Tax Department has launched a new thing. Digital Form-16. This thing will make your ITR filing easy in a jiffy.

What was the problem earlier?

- In the old Form-16, information like salary, TDS had to be manually matched with Form 26AS and AIS (Annual Information Statement).

- Sometimes the salary figure was wrong, sometimes the TDS was less. In such a case, the refund used to come late or a notice used to come.

- Many times companies used to delay in issuing Form-16 (after June 15), due to which the work of filing ITR used to stop.

How will ITR Digital Form-16 work?

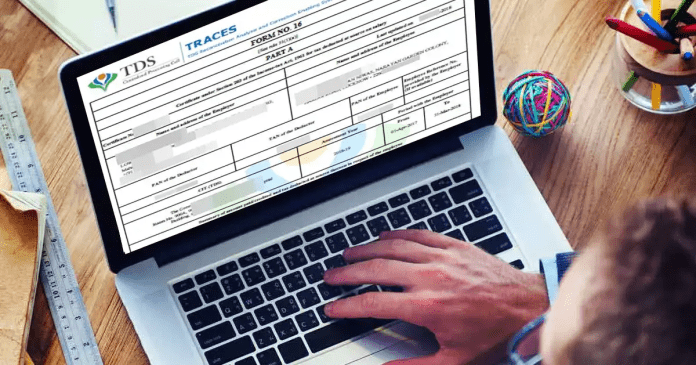

Available directly from TRACES portal: This form will now be uploaded by your company directly on the TRACES portal. It will contain complete details of salary, TDS and deductions like Section 80C/80D.

Auto-fill data: As soon as you select the ITR form, this digital Form-16 will automatically fill in all the information. All you have to do is check if everything is correct.

Alert on error: If there is any data mismatch (salary appears differently in Form-16 and AIS), the system will immediately show a red flag. Only after correcting it, you will be able to proceed.

What are the benefits?

Time will be saved: Due to auto-fill of data, it will not take even 10 minutes to fill ITR.

Mistakes disappear: No manual entry eliminates the fear of typing errors.

Safe and confidential: The form will be password protected. No one else will be able to use it.

Benefit to the environment: No need for paper Form-16, no hassle of taking print outs.

How to use

Step 1: Login to the Income Tax e-filing portal.

Step 2: Select the digital Form-16 linked to your PAN.

Step 3: As soon as you select the ITR form, all the data will be filled automatically. Just confirm and submit.

This step is not only a relief for the common people, but will also make the work of the tax department easier. Now neither will the refund come late, nor will there be the stress of notice. Next time while filing ITR, remember, digital Form-16 is your new companion.

Most Read Articles:

- Indian Railways New Rules: Good news for passengers! Now travel in 3AC at the fare of sleeper, know railways new rules

- 8th Pay Commission Salary Hike: Good news! These Central employees new salary will be ₹28,600 due to fitment increase, know ….

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide