What is a Form 16

A Form 16 is a certificate issued to salaried individuals from their employer when he deducts tax from the employee salary. In simple words, it is an acknowledgement which states your deducted tax has been deposited with the income tax department.

Form 16 is an important document that is issued in accordance with the provisions of Income Tax Act,1961. A form 16 contains details of the amount of tax deducted at source (TDS) on salary by your employer alongwith the salary breakup for the financial year. In a nutshell, it could be said that a Form 16 is a certificate of proof of the TDS deducted & deposited by your employer.

Who issues Form 16

Income Tax Law, mandates the employer who holds TAN no and deduct tax on salary of employee to issue Form 16. If your tax is not being deducted then your employer can refuse to issue Form 16 to you.

When Form 16 is to be issued?

It must be issued by 31st May of the year for which it is being issued. For example, for the F.Y. 2016-17, the due date for issue of Form 16 shall be 31st May, 2017.

If any employer delays or fails to issue Form 16 by the specified date, then he is liable to pay a penalty of Rs.100 per day till the date the default continues.

How to understand Form 16?

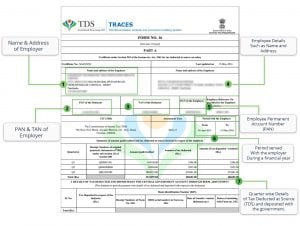

Understanding form 16 is very simple. It is divided into two sections- Part A and Part B.

- Part A: This part of Form 16 is issued by the government. It shows quarter-wise details of your tax deposited with the government. The details mentioned in Part A are as follows:

- Part B: This part shows the detailed computation of Income, on the basis of which tax is being calculated and deducted by your employer. It contains the breakup of the salary earned by you, various deductions, exemptions (if any) and the tax computation after considering all the items on the basis of current tax slab rates. The details mentioned in Part B are as follows:

- Amount of Gross Salary (1)

- Exemptions and Allowances Considered (2)

- Deduction – Entertainment Allowance and Tax on Employment (3)

- Income chargeable under the head Salary (4)

- Any Other Income reported by employee(5)

- Gross Total Income (6)

- Deductions under Chapter VI-A(80C, 80D, 80E etc) (7)

- Total Income (8)

- Tax on Total Income (9)

- Education Cess (10)

- Tax Payable (11)

- Relief under section 89, if any. (12)

- Tax Payable (13)

- Verification of the above mentioned details by the employer. (14)

In case, you are wondering how your Form 16 is prepared, here’s a brief of how things happen:

How does the Form 16 process work?

As per the procedure laid down by the Income Tax Department, the person deducting your tax files return with the government. Thus, The TDS entries get updated in the department’s database once your employer files the TDS return. The last date to deposit the TDS for the month of March is April 30. The TDS return for the last quarter (Jan to March) is to be filed latest by 31st May. After the TDS return is filed, it takes 10 to 15 days to reflect the entries in department’s database. Then after, your employer downloads the Form-16 and issues it to you.

Why do I need Form 16?

Form 16 is a very important document as it:

- Serves as a proof that government has received the tax deducted by your employer;

- It assists in the process of filing your income tax return with the Income Tax Department.

- Many banks and financial institutions demand Form 16 for verification of the person’s credentials while applying for loans.

How do get Form 16?

Form 16 is issued by your employer and you can expect it by the end of May/June. But if it’s not issued by the end of June, then you may demand it from your employer. Generally, the accounts or HR department issues Form 16.

I lost my Form 16, what should I do?

Form 16 is the most important document for you to file your income tax return and you should preserve this document carefully. But if you’ve lost it, do not panic, check your mail whether it has been emailed to you by your employer or not. If it’s not sent to you on your email, then you can simply request your employer to issue a copy of Form 16.

Is Income Tax Return and Form 16 same?

No, a Form 16 is not equivalent to an Income Tax Return but it’s the source document for your salary income. It is really helpful, especially in case your entire income is from salaries and there is no other source of income. Further, you don’t need to attach your Form 16 with your income tax return.

I haven’t received any Form 16 from my employer; do I still need to file my income tax return?

If your Gross Total Income exceeds 2,50,000 [for F.Y. 2016-17] then it is mandatory to file income tax return. Your employer is liable to issue form 16 only when he has deducted tax from your salary. If your employer does not deduct tax and your income exceeds the specified limit then even if you don’t have form 16, you are required to file return of income.

I haven’t received Form 16, how do I calculate my Salary Income?

If you haven’t received a Form 16, then for the purpose of return filing, you will have to refer to your salary payslips, bank statements, tax-saving investment proofs, home and education loan certificates and Form 26AS etc for filing income tax return. While payslips contain details of your income like basic salary and allowances, Form 26AS contains the details of all your tax deducted and tax paid.

For example, Ms. Tania was working with XYZ Ltd. and she didn’t receive any Form 16. In such a case, she consulted experts and they calculated the income on the basis of her monthly payslips which showed a basic salary of Rs. 30,000 per month. It also had details of transport allowance of Rs. 2,000 per month. Further, she had her home loan certificate, because of which she was allowed a deduction of Rs. 50,000 from her income. Hence, the final calculated income of Ms. Tania would be calculated as follows:

Basic Salary = 30,000 x 12 months = 3,60,000

Transport Allowance = 2,000 x 12 months = 24,000 but subject to an exemption of Rs. 1600 per month.

Therefore, 400 x 12 = 4,800 is taxable.

Hence, the Taxable Income [after deducting the basic exemption limit] of Ms. Tania will be Rs. 64,800 (3,60,000 + 4,800 – 2,50,000 (basic exemption) – 50,000 deduction for home loan).

My employer has deducted tax from my salary, but neither did he issue me a Form 16 nor does my Form 26AS show any such deduction entries?

In such a case, where your employer deducted tax from your salary, but you are not able to trace such deduction in Form 26AS, then it may happen that your employer has deducted the tax from your salary but has not deposited the same in the credit of the Government account. And, in such a case, you must pay full amount of tax while filing your income tax return. Also, you should immediately bring this matter or default to the notice of your employer.

I want to claim a deduction under Chapter VI / other exemptions / allowances in my income tax return which is not in my Form 16? Can I do it?

In a case where your employer issues you a Form 16 without any deductions, you can still claim the deduction in your income tax return. Form 16 is just a certificate issued by your employer which certifies deduction of tax (TDS) on your salary. It’s just a base document for return filing and not the final return itself. You can always take the benefit of the deductions you are eligible for, while filing your income tax return even if the same are not mentioned in your Form 16.

Our experts say “Always remember to check whether the House Rent Allowance exemption has been taken in Form 16 or not (if you’re entitled to it). It is usually either not reflected or calculated at a wrong value especially in the case of multiple employers during the year. In such an event, you yourself can calculate it and take the exemption of same while filing your income tax return.”

Is Form 26AS different from Form 16?

| Form 26AS | Form 16 |

|---|---|

| Contains details of tax deducted at source (TDS) for all the heads of income. | Contains details of tax deducted at source (TDS) for the income from salary only.

The details of other heads of income can also be provided in your Form16, in case you have provided the details of other income to your employer. |

| Provided on the Department’s site based on data submitted by all the Deductors. | Issued by your employer to you. |

My Form 16 is incorrect, what should I do?

In case, where a Form 16 is duly issued but with a mistake, then the same can be rectified by your employer on your request. Subsequently, a revised Form 16 will be issued to you by your employer.

I switched my job during the year, how should I file my return now?

It is very much possible for you to change your job in the middle of the year, but then you may be wondering who will issue Form 16.

In case, you had two employers for the year, you will get Form 16 from both the employers for the respective months served by you. The income tax return will be filed by combining the details of both the Form 16s. But you must be careful in doing so because it might happen that both your former and present employer has calculated your tax after taking into the consideration the basic exemption limit. In such a case, you are not entitled to take the benefit of exemption limit twice, but only once.

The same applies to all deductions and allowances during the year, as any deduction / allowance can be claimed only once or as per the respective rules of the income tax law even if it is reflected in both the Form 16’s.

For example, let’s say, in the year 2016-17, you worked with a company X Pvt. Ltd. for a period of 6 months for a salary of Rs. 45,000 per month and for the rest 6 months you joined Y Ltd. for Rs. 50,000 per month. In such a case, you draw a salary of Rs. 2,70,000 from X Pvt. Ltd. and Rs. 3,00,000 from Y Ltd. Now, both the companies X Pvt. Ltd. and Y Ltd. will deduct your tax after consideration of the basic exemption limit (i.e. Rs. 2,50,000/-) only and your Form 16 will be based on the same. This means X Pvt. Ltd. will charge tax on the balance Rs. 20,000 and Y Ltd. will charge tax on Rs. 50,000, each giving you an exemption of Rs. 2,50,000. But, at the time of filing your final return for the year, you will be allowed the basic exemption only once and not twice i.e. your tax should be charged on Rs. 3,30,000. (Rs. 300000 + 270000 – 250000).

Further, when you switch jobs in a year, then you should furnish your previous employer’s TDS details to your new employer in Form 12B.