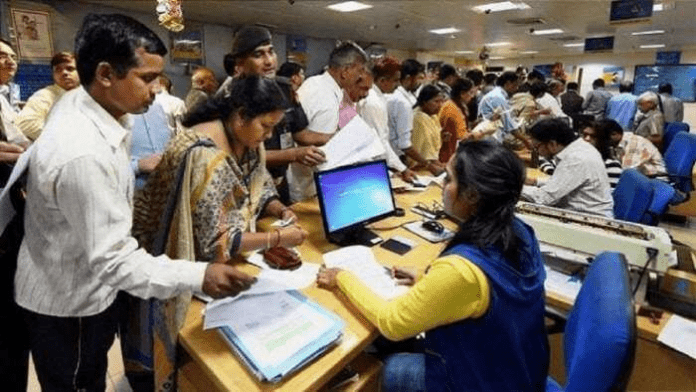

FD Premature Withdrawal: Even today, investors prefer to invest in FD i.e. Fixed Deposit. It is considered the safest platform. If you also want to withdraw money from FD before the need but are unaware of the charges or penalty (FD premature withdrawal charges) or want to avoid the charges, then read the full article below.

FD Premature Withdrawal: Fixed deposit is still the favorite platform of investors. Even today, many of us prefer to keep our money in FD, because it gives guaranteed returns. However, your money remains in FD for a fixed limit. This limit is called maturity.

If a person withdraws before maturity, then he may have to pay a hefty charge. First of all, let us know how much charge you will have to pay on withdrawal before maturity. This charge depends on the time of withdrawal and the amount deposited.

How much charge may have to be paid?

If you withdraw the money deposited in FD even before the completion of one year, then 0.50% charge will have to be paid. Similarly, if the limit in FD is more than 5 crores, then also this charge will remain 0.50%. Similarly, if you withdraw money between 1 to 5 years, then 1% will be charged. Whether the limit is 5 crores or more.

But if you withdraw money after 5 years or after that, then this charge will be 1% in FDs less than 5 crores and 1.50% in FDs more than 5 crores.

How to avoid the charge?

Do not withdraw the entire amount

Some banks give their customers the option of partial withdrawal in FD i.e. withdrawing a small amount, for this you do not have to pay the charge for the entire amount and your charge also gets reduced. But what will happen if we need the entire deposit amount due to medical emergency?

Flexibility

Some banks or financial institutions give the option of withdrawal on their FDs in case of need, such as in case of medical emergency. You can also choose such FD. You have to keep these things in mind before taking FD. If we are not able to find a bank that provides this facility, then what should we do?

Wait

If the maturity of FD is going to be completed soon, then it is wise to wait a little more. But if there is still a long time left for the FD to mature and we need money immediately, then what should we do?

Loan on FD

If you cannot wait, then you can choose the option of loan on FD. Many banks provide you loan on the amount deposited in FD. The loan amount depends on the deposit amount and the rules of the bank.

How much is the loan interest on FD?

Usually, on taking a loan on FD, this interest rate is 1 to 2 percent more than the FD interest. There is also a limit to repay this loan. You can take it in the form of overdraft or demand loan from the bank.

Most Read Articles:

- Bank FD Rates: Great news for customers! More than 8% interest on fixed deposits, Check latest rate

- FD Rates: These banks are giving up to 7.85% interest on 3-year senior citizen FD, check details to earn good money at fixed rate

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide