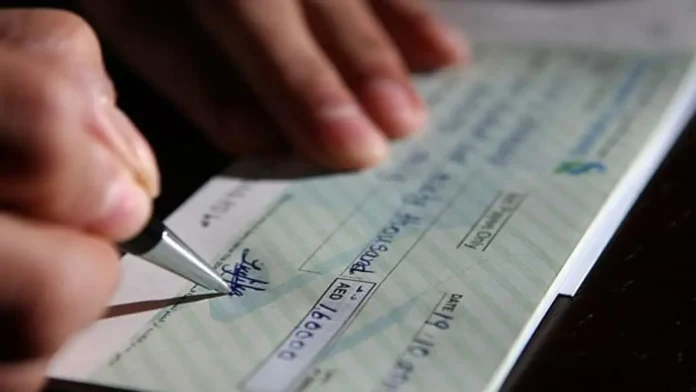

RBI Cheque Payment Rules: The Reserve Bank of India (RBI) has given relief to crores of bank customers who make payments by cheque. Till now, it takes 2 to 3 days for the money to come into the account on payment by cheque. But now this will happen in just a few hours

RBI Cheque Payment Rules: The Reserve Bank of India (RBI) has given relief to crores of bank customers who make payments by cheque. Till now, it takes 2 to 3 days for the money to come into the account on payment by cheque. But now this will happen in just a few hours. RBI has changed the rules and process of cheque payment. These new rules will come into effect from October 4, 2025. That is, after Dussehra and before Diwali, crores of bank customers will take just a few hours instead of three days to make and receive payment by check. That is, the money will come into the account on the day the check is deposited in the bank.

How much time does it take for the cheque to be cleared now

At present, it takes T+1 i.e. the next working day for the cheque to be cleared. If the check is from another bank, it can take three days. Now this system will be reduced to a few hours instead of days.

What will change?

Currently, in the Cheque Truncation System (CTS), cheques are processed in batches, in which clearing takes one to two days. In the new system, the cheque will be scanned and sent electronically immediately and will be processed continuously throughout the day (Continuous Clearing). That is, cheque clearing will continue continuously during banking hours.

What is CTS

CTS is an electronic system in which there is no need to carry a physical copy of the cheque. Instead, the image and details of the cheque are sent electronically to the paying bank. This speeds up the process and also reduces the possibility of fraud.

The system will be implemented in two phases

RBI said that this change will be implemented in two phases. The first phase will run from 4 October 2025 to 2 January 2026. During this period, banks will have to verify (positive or negative) all the cheques received till 7 pm. If the bank does not do the verification on time, then the cheque will be considered accepted and included in the count of settlement.

The second phase will start from January 3, 2026. In this, the rules will become more strict. Verification of every cheque will have to be done within 3 hours of receiving it. For example, if a bank receives a cheque between 10 am and 11 am, then it will have to do the verification by 2 pm. If verification is not done within this time limit, then it will be considered accepted.

What will be the benefit to the customers?

Under the new rule, as soon as the process is completed, the bank presenting the cheque will immediately issue payment to the customer. This payment will be made within one hour of settlement, provided all security cheques are completed. That is, if you deposit the cheque in the morning, then it is possible that the money will come to your bank account by the same afternoon or evening.

What will the bank have to do?

RBI has instructed all banks to give complete information about this change to their customers. Also, they have to keep their technical and operational processes ready so that the work of clearing cheques can be done continuously from the due date.

Most Read Articles:

- EPFO 3.0 Update: TCS, Infosys and Wipro shortlisted to create new IT platform, know what will be the major changes

- Post Office FD Scheme: If you deposit ₹4,00,000 in 24 month FD of wife name in Post Office, how much money will you get on maturity, check the calculation

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide