Cash withdrawal from smartphone is going to be even easier now. UPI, which is used everywhere in the country, is currently used for sending money, paying bills and online shopping. Now it can be used for cash withdrawal as well.

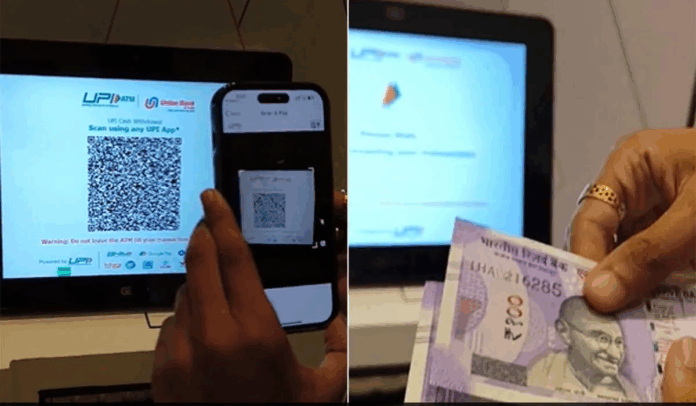

Now withdrawing cash from smartphone is going to be easier. UPI (Unified Payments Interface) which is used everywhere in the country, which is currently used for sending money, paying bills and online shopping. Now it can also be used for cash withdrawal. It is reported that National Payments Corporation of India (NPCI) is now preparing to start the facility of withdrawing cash by scanning QR code. For this, lakhs of Business Correspondents (BCs), such as grocery shopkeepers or small service points, will provide QR codes. Customers will be able to withdraw cash by scanning the code from any UPI app in their mobile.

What is the detail

According to a report in the Economic Times, the National Payments Corporation of India (which runs the retail payments and settlement system in the country) has sought permission from the RBI to allow cash withdrawal facility through UPI at Business Correspondents (BCs). According to the report, a senior NPCI official said that this facility is still at the planning stage and a final decision has not been taken on it yet.

Let us tell you that as of today, cardless cash withdrawal from UPI is possible only from those ATMs (which are UPI-enabled) or from some selected shopkeepers. There is a limit there too. For example, in cities and towns, only up to ₹ 1,000 cash can be withdrawn on every transaction. In rural areas, this limit is up to ₹ 2,000. Now a plan is being made to extend this facility to more than 20 lakh Business Correspondents (BCs) across the country.

Who are BCs?

These are small centres or people who often live in remote or unbanked areas and work as an extension of bank branches. That is, they help in providing banking and financial services to the people. Let us tell you that NPCI itself created and launched UPI in the year 2016.

How will it work-

The government and the banking sector are working on making cash withdrawal easier with UPI. When a customer visits a BC outlet, he will scan the QR code from UPI.

- That amount will be debited from the customer’s account.

- The same amount will be credited to the BC account.

- After that BC will give cash to the customer.

What options are available right now-

At present, customers can withdraw money from micro-ATM machines available with BCs by inserting ATM cards. But this method is rarely used.