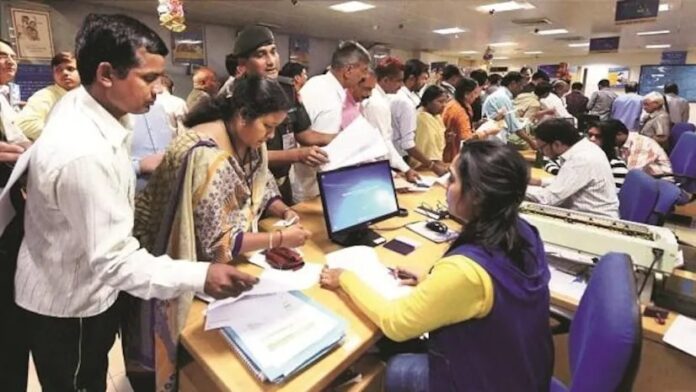

1 November 2025 New Bank Rules : Every new month begins with some rules changing. This time, the rules for bank savings accounts and lockers are set to change from November 1.

Customers can now designate more than one nominee for their savings account and bank locker. Let’s find out what changes the government has made to the rules.

What the new rules say

The RBI’s new guidelines include nomination facilities for deposit accounts, safe deposit lockers, and safe custody. Under these guidelines, all banks, whether private, cooperative, or rural, will now be required to provide nomination facilities to their customers. If a customer does not wish to nominate, they can opt out by submitting a written declaration. The RBI has clarified that banks cannot delay account opening if this occurs.

What banks need to do

Banks must acknowledge the nomination form within three working days of receiving it. The passbook or fixed deposit receipt must state “Nomination Registered.” The bank must also clearly record the nominee’s name in its records.

The RBI has directed banks to launch awareness campaigns to educate customers about the need for a nominee. Customers can change or cancel their nominee at any time, and the bank must provide written verification immediately.

If a nominee is found to be legally inaccurate and the bank rejects it, the bank must provide written reasons within three days. If a nominee dies, their nomination will automatically be cancelled. The RBI had previously stipulated that banks must settle claims within 15 days of a customer’s death and compensate for any delays.