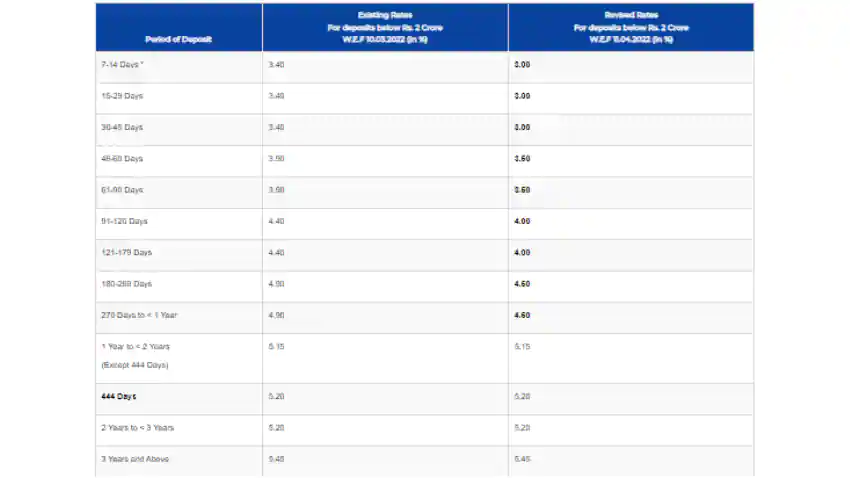

Fixed Deposit Interest Rate: Now for FDs with a tenure of less than Rs 2 crore in the bank, the interest rate on various maturities is starting at 3 percent per annum. The highest interest rate of 5.45% per annum is on FDs with tenures of 3 years and above.

Fixed Deposit Interest Rate: There are many people in the country who have done their future planning. In such a situation, people first think about their savings. Fixed deposit is also the best option for saving. If you have made an FD in Indian Overseas Bank (IOB), then there is no good news for you. Indian Overseas Bank has cut interest rates by 0.4 percent for FDs with various short term tenors. This has been made effective from April 11. The bank has given this information on its website. Let’s know the complete details.

Let us tell you that for FDs of less than Rs 2 crore in the bank, the interest rate on various maturities is starting at 3 percent per annum. The highest interest rate of 5.45% per annum is on FDs with tenures of 3 years and above. Let us know what are the new interest rates.

New interest rate for senior citizens

The minimum amount for an FD in IOB with tenure of 7 to 14 days is Rs 1 lakh. On the other hand, senior citizens get an extra interest of 0.50 percent over and above the regular interest rate. At the same time, for super senior citizens i.e. people of age 80 years and above, an additional interest of 0.75% is available in IOB over the regular interest rate.

HDFC Bank increased rates

HDFC Bank recently increased the interest rates for FDs below Rs 2 crore on select maturity periods. The new rates have come into effect from 6 April 2022. Now in HDFC Bank, the interest rate has been increased by 0.1 per cent to 5.10 per cent per annum for FDs of one year tenor and ‘one year one day to two years’ tenor. Earlier this rate was 5 per cent per annum.