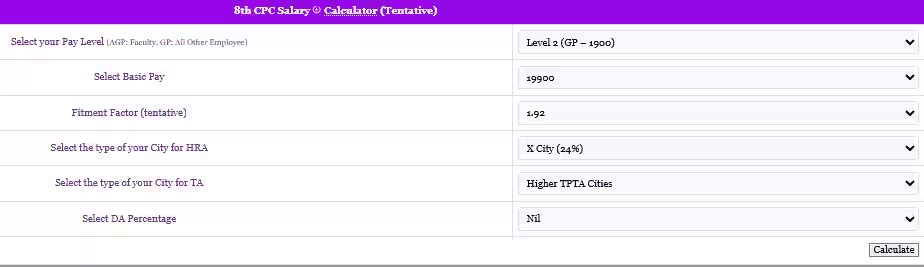

8th CPC Salary Calculator: How much money will come in the pockets of Level-2 (GP-1900) employees? What will be the new basic pay? How much will be the fitment factor? And what will be the total net salary after adding HRA (House Rent Allowance) and TA (Travel Allowance) to all these?

8th CPC Salary Calculator: The wait for the 8th Pay Commission for central government employees now seems to be a guest of just a short time. Everyone has the same question in their mind that how much will be the increase in their salary, especially how much money will come in the pockets of Level-2 (GP-1900) employees? What will be the new basic pay? How much will be the fitment factor? And what will be the total net salary after adding HRA (House Rent Allowance) and TA (Travel Allowance) to all these? If all these questions are roaming in your mind too, then we will clear all your curiosity. Today we will tell you how the complete calculation of your increased salary can look on the basis of an ‘8th CPC Salary Calculator’. So let’s know how much the new net salary can be at Level-2.

What will be the Fitment Factor?

The Fitment Factor plays the most important role in deciding the basic salary of central employees. In the 7th Pay Commission, it was 2.57, due to which the minimum salary increased from ₹ 7,000 to ₹ 18,000. Now there are different estimates regarding the fitment factor in the 8th Pay Commission – 1.92, 2.08 and 2.86. This will decide how much the new salary of the employees will be. In many reports, the possibility of keeping the fitment factor around 1.90 or 1.92 has been expressed on the lines of the old pay commissions. The fitment factor of the 8th Pay Commission has not been officially decided yet, so we are using a possible fitment factor (1.92) in the calculation given here.

What can be the salary in the 8th Pay Commission?

| Pay Level | 7th Pay Commission (Basic Pay) | 1.92 fitment factor | 2.08 Fitment Factor | 2.86 fitment factor |

|---|---|---|---|---|

| Level 1 | ₹18,000 | ₹34,560 | ₹37,440 | ₹51,480 |

| Level 2 | ₹19,900 | ₹38,208 | ₹41,392 | ₹56,914 |

| Level 3 | ₹21,700 | ₹41,664 | ₹45,136 | ₹62,062 |

| Level 4 | ₹25,500 | ₹48,960 | ₹53,040 | ₹72,930 |

| Level 5 | ₹29,200 | ₹56,064 | ₹60,736 | ₹83,512 |

| Level 6 | ₹35,400 | ₹67,968 | ₹73,632 | ₹1,01,244 |

| Level 7 | ₹44,900 | ₹86,208 | ₹93,392 | ₹1,28,414 |

| Level 8 | ₹47,600 | ₹91,392 | ₹99,008 | ₹1,36,136 |

| Level 9 | ₹53,100 | ₹1,01,952 | ₹1,10,448 | ₹1,51,866 |

| Level 10 | ₹56,100 | ₹1,07,712 | ₹1,16,688 | ₹1,60,446 |

How much salary will Level-2 pay band holders get from January 2026?

| 8th CPC Salary Calculator (Tentative) | |

|---|---|

| Select your Pay Level (AGP: Faculty, GP: All Other Employee) | |

| Select Basic Pay | |

| Fitment Factor (tentative) | |

| Select the type of your City for HRA | |

| Select the type of your City for TA | |

| Select DA Percentage | |

| Salary from January 2026 (per month) | |

|---|---|

| Your Pay Level | |

| Basic Pay | |

| Revised Basic Pay ( with fitment factor) | |

| DA ( Dearness Allowance) | |

| HRA (Hourse Rent Allowance) | |

| TA (Travelling Allowance) | |

| Other Allowances/Incomes (if any) | 0 |

| Gross Salary | |

| NPS Contribution | |

| CGHS Contribution | |

| Income Tax (New Regime FY:2025-26) (approx) per annum | (approx) |

| Other Deductions (if any) | 0 |

| Net Salary |

Now let’s understand the calculation

According to the above calculator, we have seen the calculation on Level-2, Grade Pay 1900 in the 8th Pay Commission. In this grade, the current basic pay as per the 7th Pay Commission is ₹19,900. The fitment factor in this is considered to be 1.92, which makes the revised basic pay ₹38,208 (₹19,900 x 1.92). ₹9,170 has been shown as HRA (House Rent Allowance). This amount varies according to the category (X, Y, Z) of the employee’s city and changes in the rates of HRA are also possible in the 8th Pay Commission. ₹1,350 has been added as Travel Allowance (TA), which depends on the category of the city and pay level. Travel Allowance (TA) has been calculated according to the higher TPTA city.

All these add up to a total gross salary of ₹48,728. However, this is not the final take-home salary. Government employees also have to pay NPS contribution (10% of revised basic) which is ₹3,821, and CGHS contribution (₹250, as per slab). After these deductions, the estimated net salary (take-home salary) at Level-2 will be ₹44,657. Dearness Allowance (DA) has been kept zero in the entire calculation, because whenever a new pay commission is implemented, dearness allowance is made zero and then its calculation starts again based on the new index.

Will DA become zero?

When every new pay commission is implemented, Dearness Allowance (DA) is made zero. Currently, DA is 55% in the 7th Pay Commission. After this, there may be an increase of 2 percent in July. But, in the 8th Pay Commission, it will be reset from zero and then its calculation will start again on the basis of Consumer Price Index (CPI-IW) and it will be increased at regular intervals.

(Disclaimer: This calculation is estimated and based on the possible fitment factor. The actual figures will be known only after the official recommendations of the 8th Pay Commission come.)