8th Pay Commission: The 8th Pay Commission proposes to increase not just the salary but also the insurance cover for government employees. The current insurance amount is very low – only ₹30,000 to ₹1,20,000 is given on death during duty. Now there is a demand to increase it to ₹15 lakh.

8th Pay Commission: The central government may not have formed a panel for the 8th Pay Commission yet. But the discussions are in full swing. Now along with the salary of the employees, another big demand is coming up – increase in insurance cover. If an employee dies during government duty, then his family gets an insurance amount of only ₹1,20,000. This is the highest and applies to Group A. Whereas in the rest of the groups this amount is very less. There has been resentment about this for a long time. If sources are to be believed, now there is news that it can be increased in the 8th Pay Commission. It is being considered to increase the cover directly from ₹ 10 lakh to ₹ 15 lakh.

How much insurance cover is available now?

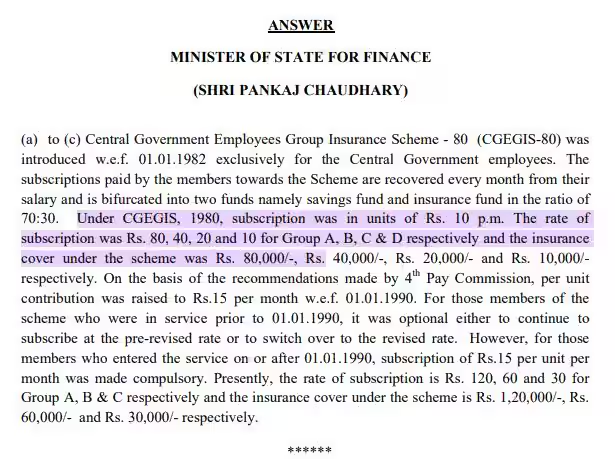

At present, government employees get insurance cover under Central Government Employees Group Insurance Scheme (CGEGIS). The central government implemented CGEGIS from 1 January 1982. Its objective was to provide insurance cover and retirement benefits to the employees.

CGEGIS: Insurance cover and subscription

In the beginning of CGEGIS, the insurance cover and subscription rates were quite low.

- Group A: Insurance cover ₹ 80,000; Monthly subscription ₹ 80

- Group B: Insurance cover ₹ 40,000; Monthly subscription ₹ 40

- Group C: Insurance cover ₹ 20,000; Monthly subscription ₹ 20

- Group D: Insurance cover ₹ 10,000; Monthly subscription ₹10

Amendment in CGEGIS

The insurance cover under CGEGIS was amended in 1990. From 1 January 1990, based on the recommendations of the 4th Pay Commission, the subscription per unit was made ₹15. This change was optional for employees who were in service before 1 January 1990, while it was mandatory for employees who joined service after that.

- Group A: Insurance cover ₹1,20,000; Monthly subscription ₹120

- Group B: Insurance cover ₹60,000; Monthly subscription ₹60

- Group C: Insurance cover ₹30,000; Monthly subscription ₹30

This information was given by Minister of State for Finance Pankaj Chaudhary in the Lok Sabha.

What changes can be made in the 8th Pay Commission?

If sources are to be believed, the government can re-design CGEGIS through the 8th Pay Commission. Given the current inflation and lifestyle, this amount is now considered irrelevant. According to sources, the insurance cover can be increased from ₹ 10 lakh to ₹ 15 lakh. Monthly subscription can also be increased slightly (eg ₹ 500 instead of ₹ 60). A new framework based on the term insurance model can also be introduced. This step will provide better protection to the families of employees. According to sources, initial discussions have already taken place on this issue between DoPT and the Finance Ministry.

What were the recommendations of the 7th Pay Commission?

The 7th Pay Commission also recommended increasing the insurance amount of CGEGIS. Insurance options of ₹ 50 lakh, ₹ 25 lakh and ₹ 15 lakh were suggested. For this, a deduction of ₹ 5,000, ₹ 2,500 and ₹ 1,500 per month respectively was proposed. But, the employees opposed it considering it expensive. As a result, the government did not implement these recommendations. Now it is expected that a practical model will be prepared by taking the opinion of the employees in the 8th Pay Commission.

Demand of the employee union

The All India Central Employees Federation (AISGEF) and other unions have described the demand for increasing the insurance cover as a major agenda. According to them, if the government cannot provide a minimum insurance of ₹ 15 lakh to the family of an employee who loses his life on duty, then it would be a great injustice.

When can the decision come?

The notification of the 8th Pay Commission may come in 2025 and it can be considered effective from January 1, 2026. If insurance cover is included in it, then the new insurance rule will come into force from the same date.

Most Read Articles:

- 8th Pay Commission: Big news! These employees will no longer get DA hike benefit and Pay Commission? know the details

- Vande Bharat Sleeper train: Good news for passengers! First Vande Bharat Sleeper train will also run from UP, route finalized, will stop at these stations

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide